It’s good to invest for retirement.

It’s even better to invest for retirement if you can also pay less in taxes during the process. That’s what the traditional and Roth IRA provide. They allow you to pay fewer taxes. But they have a few differences, which I will explain below.

The federal government has decided to encourage you to do your own saving for retirement. You see, back in the good ole days, everyone either had a pension from their employer, or they just worked until they died. Only the rich were investing in the stock market.

In the modern era of investing, the pension started to go away. Thus, the government started feeling pressure to take care of older citizens. Because social security isn’t supposed to be a complete answer to your retirement needs, and because Americans started living longer, they needed a solution. They needed something to encourage do-it-yourself investing.

Traditional IRA

Along came ERISA and the traditional IRA in 1974. The traditional IRA is a retirement account in which the contributions you make to that account are tax-deductible. In other words, if you contribute $1,000 to a traditional IRA, you will be able to reduce your taxable income for the year by $1,000. Depending on your tax bracket, this could mean up to $250 in tax savings. All that just for saving for your retirement.

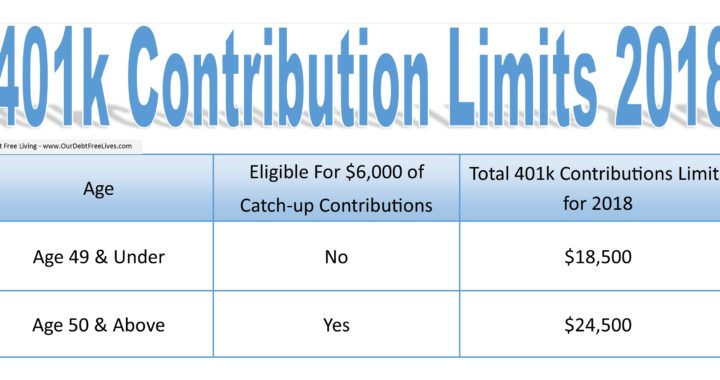

Over the years, the traditional IRA has seen come changes. We now have limits to the amount that you can contribute each year towards your IRA. Also, if you participate in an employer sponsored plan, like a 401K, you will not typically be able to invest tax-deductible dollars into a traditional IRA. Additionally, if you make over a certain amount each year, you will not be able to contribute tax-deductible dollars to your account.

When you pull money out of your traditional IRA (called a distribution), you will have to pay taxes on the money. So even though you skipped the taxes on the way end, you will make it up in retirement. Your contributions and earnings from those contributions will be taxed when you pull them out.

Lastly, you should know that there are penalties if you pull money out of your traditional IRA before you retire, and there are also required minimum distributions you must make starting in retirement. The traditional IRA has a lot of restrictions, but it’s the best place to save for retirement for those without a 401K who are looking for an instant tax deduction.

Roth IRA

That brings us to the Roth IRA. The Roth IRA was created by the in Tax Act of 1997, which was authored by William V. Roth, Jr., a Senator from Delaware. The Roth IRA was aimed at helping people save outside of their employer 401Ks.

You contribute after-tax dollars to a Roth IRA, but when it’s time to withdraw those funds in retirement, you can do so tax-free. Nice, right? Just like the traditional IRA, the Roth has income limits and contribution limits you must deal with. See more at the Roth IRA explained.

Other than that, there’s not much downside. Since the funds are after-tax (meaning you’ve already paid taxes on them), you have a lot more flexibility. You can withdraw your contributions without many limits and you can withdraw them in retirement any time you want. No required minimum distributions.

Traditional IRA vs Roth IRA

A good thing to keep in mind is that if you qualify for both accounts you can certainly contribute to both. There’s no rule saying you can’t. Keep in mind that if you do, you need to watch your contribution limits as those will be spread across both accounts.

The traditional IRA and Roth IRA are both excellent tools to help you get started with your retirement savings effort. It’s more important to get started with something than stopping down because you are stuck deciding which one of these is the best.

As a quick rule of thumb, I like to tell people that if you don’t have a company 401K, then consider the traditional IRA if you want to see some savings to your high tax bill. If you do have a company 401K, then just go with a Roth IRA to do all of your extra investing. That’s what I do.

Once you decide which account to use, you can start thinking about what to put inside your IRA. Good luck.

Related Articles: