Can you contribute to a Roth IRA and 401k? Yes, you can contribute to a Roth IRA and 401K at the same time.

In this post I’ll share my experience of simultaneously contributing to a Roth IRA and 401K, as well as the requirements you’ll need to meet in order to do the same.

When it’s time to get serious about your retirement, it’s not a stretch to imagine you might start thinking beyond your 401K. If you have a 401K at work, that’s great. Your employer cares about you and your ability to support yourself in retirement. If your employer is offering a matching contribution, well, you’ve struck gold. That’s free money. The next logical step is to consider a Roth IRA.

Before you consider a Roth IRA, you should be fully taking advantage of your company 401K. By that I mean contributing enough annual dollars to get the full match that the company offers. It’s likely that you are already doing that so let’s dive into the next step of also investing in a Roth IRA.

As a side note, if you don’t have a 401K, then consider reviewing the Difference Between Roth IRA and Traditional IRA.

Difference Between 401K and Roth IRA

Remember that the Roth IRA and 401K are just accounts where you keep your investments. They aren’t actual investments. They are just the account (or vehicle, as some put it) where the money is held. These accounts are great because they get special tax treatment.

You are able to contribute pre-tax dollars to a 401K. This means that no tax is taken from your money that is placed into the 401K. If you earn a dollar and put it in your 401K, you pay $0 in taxes on that dollar. If you earn another dollar and put it in your checking account instead, you have to pay taxes on that money.

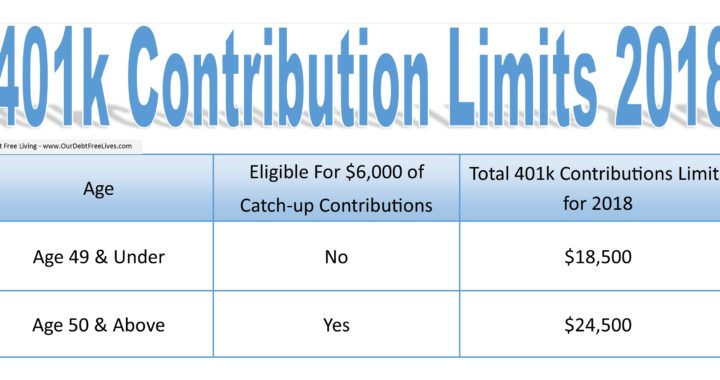

There is a limit to your contribution though. It changes every year usually, but right now you can contribute $18,500 (2018) to your 401K.

You can’t contribute pre-tax dollars to a Roth IRA. You can only contribute dollars that have been taxed already. However, unlike a 401K, when you distribute that money to yourself in retirement, you don’t have to pay a tax. Nice, huh? For more on this account see the Roth IRA Explained.

401K and Roth IRA

Because the Roth IRA and 401K have opposite tax treatments, the IRS allows you to contribute to both at the same time. The only thing you have to worry about is the income limitation set on the Roth IRA. Your ability to contribute to a Roth IRA starts to “phase out” at $189,000 (2018) for those who file “married filing jointly”.

Here’s a strategy I follow. To contribute to both of these accounts, just make sure you start with contributions to the 401K to get the match. Then, switch to contributing to the Roth IRA. Once that is maxed out for the year ($5,500 for 2018), then you can go back to the 401K until you reach your annual limit there.

I did that for the tax years 2016 through 2017 and saw significant increased in my tax-advantaged retirement investing accounts. Not to mention, I have two different account with different distribution rules. So now I can consider things like using my Roth IRA for a down payment.

How about you, do you contribute to a Roth IRA and 401K at the same time?

Related Articles: