Summer is just around the corner, and while some are worrying about sculpting their summer physiques, my concern focuses more on trimming up my summer budget. Summer is a spend-heavy season, synonymous with vacations, road trips, and even smaller-ticket items like ice cream trips that can still really add up.

I want to enjoy all of that, but I want to be able to do it guilt free. Fortunately, there are a number of ways to cut down spending before summer, so that your savings won’t take a hit when it’s time to get up and get out. The money you save can help you pay off debt using the debt snowball spreadsheet.

Enjoy What You Have

It may seem like a trivial bit of advice, but psychological evidence is stacking up to suggest that creating a positive mindset when it comes to what’s already in your life can help you control larger habits, including spending.

The underlying ideology is that creating contentment with what one has counteracts the need to refresh or replace; a need that’s constantly fed to us, because the free market is only as good as its ability to sell in the marketplace.

Think about the mania surrounding the iPhone as an example. We all know someone who lines up at midnight to be one of the first to get their hands on a new generation, even when they had a perfectly functional piece of technology beforehand.

We want the new phone because it’s supposed to be better, more capable, and have a more rewarding user experience. At the end of the day, though, a new phone might alter our mood for a few hours, but what does it do for us long-term that one generation previous couldn’t?

Small things like simply writing down a few things you appreciate in your life and taking the time to do things you can enjoy for free can get your mind off of spending and help you focus on the material items in your life that are truly, functionally worth the cost of addition or replacement.

Here are a few free things worth trying that might just lead to a pretty great time:

- Going for a walk through a nice part of town

- Checking online for free neighborhood activities or festivals

- Finding a museum with a free admission day

- Organizing a game night or fantasy sports league

- Using sites like Meetup.com to meet people who share similar interests

You’d be surprised at how many fun ways there are to pass the time that don’t cost a penny, especially during the summer season.

Set No-Spend Goals

Once your head is in the right place, challenge yourself to not spend outside of necessity. The Budget Diet ran the numbers, and if you cut down spending by $13 a day, you could save $400 a month, which comes out to around $4,800 a year.

Living completely no-spend is difficult, but going no-spend for short bursts can help cut out those unnecessary costs, such as impulse buys, entertainment costs, and even things like clothes and shoes that are eating up thousands of dollars of savings a year. Spending only on necessities such as bills, groceries, and gas for even a week can add up.

Take me, for example. I have a set food budget every month that gets me more than enough at the store to get by. For the sake of convenience, though, I rarely bring lunch and thus spend about $10 five days a week grabbing a bite. If I went no-spend for one week, my lunch expenses alone would save me $50.

The idea of no-spend is not to get you to give up all spending, but rather to create short savings bursts that can help you better evaluate what is really worth your time and cash. Free apps like GoodBudget and Mint can even help you keep track of your spending easily and on the go.

Get Minimalist

Minimalism is as hot a trend in finance as it is in design, and believe it or not, the two actually kind of pair. This is a big and small change coupling, where you need to go through both your current space, expenses and see what you can cut.

Minimizing things like clothing, furniture, and home décor is a cent-on-the-dollar kind of change that can not only help with creating a clear headspace when it comes to cash, but will also save you a little bit each time you downsize since there is less that has to be cleaned and maintained, meaning less spending on things that aren’t that important.

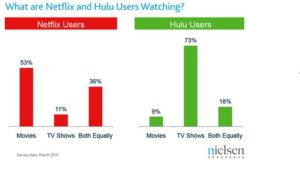

The next step is go through and financially clean up those things that you’re actively paying for, but don’t really need. If you’re paying for a cable package, for example, but spend most of your time binge watching Netflix, cutting your package down to just internet could be a savings of $100+ a month.

Go through your services, utilities, insurance, etc., and see what can be cut down based on what you actually use. Pay specific attention to services like car insurance, cable and internet, cell phone plans, and anything that comes in bundles. You may be able to cut it down to just the services you need and save in the process.

Change Your Transportation

There are a lot of ways to save on transportation, especially if you drive yourself. Taking advantage of even one of these even once a week can cut some major fat from the gas budget:

- Take public transportation

- Walk or bike to work

- Participate in a commuter carpool

- Take advantage of pretax commute payment options

Changing the way you get to work can greatly impact the way you save. Paying with pretax dollars, alone, can save commuters hundreds a year without even having to change the way they get around, and the American Public Transit Association estimates that by switching from driving to transit, commuters could save between $8,960 and $14,612 annually. I was actually very surprised when I saw this.

Cut Back On Inflating Items

A good beer is one of the great indulgences in my daily life, but did you know that between July and August of 2018, the average cost of alcohol and tobacco products went up by 1%? Considering that’s just one month, that’s a climb worth noting.

The good news is, these things tend to move in cycles, and prices both rise and fall over time. Keeping track of what’s on an upswing (such as alcohol) and where deals are good (such as gas) can help you prioritize your spending so that you can focus more money on what will get you further.

If you really do have a bar you’re seeking to stock, fear not. There are plenty of Apps that can help you compare prices both in store and online to help you make sure you’re getting the best deal on those things you just can’t do without.

Sell Before You Buy

If spending really must be on the table, you might as well get a return on it, even if it’s small. Look at selling earlier versions of the items you’re looking to purchase, especially for larger items like new technology, household appliances, or anything that’s going to take three or four figures out of your account.

Selling off your old wares won’t cover the full cost of the new one, but it will help recoup some of the budget, and mitigate overall costs by tens of percentages at a time. Items with the highest resale value on private listing online marketplaces such as eBay and Craigslist include:

- Cell phones

- Power tools

- Yard equipment

- Computers

- Electronics

- Gently used furniture

- Bicycles

- Motorcycles and scooters

- Large household appliances

- Cars

Through a mix of cutting expenses, smart spending, and a healthy mental attitude when it comes to money, getting your budget in line before summer is completely possible. Of course, these things are good year-round, but now’s the time to rake in the savings so that you can enjoy fun in the sun without any added financial stress.