A Credit Card is a Means to Borrow Money

How do credit cards work? When you boil it all down a credit card is simply a convenient means to borrow money. In other words, when you use a credit card to pay for something it’s not really you that’s paying for it; the credit card issuer (the bank or financial institution that issued you the credit card) is paying for it. That means when you use a credit card to make a make a purchase the seller is happy, because they get their money. However, the transaction isn’t over as far as you’re concerned because now you owe the credit card issuer. In summary, when you use a credit card you’re borrowing money from the credit card issuer pay for things, and then you’re obligated to pay off your credit card balance.

Payment Options

When answering “How do credit cards work?” keep in mind your credit card issuer obsesses over how much money you owe them. Without fail every month they’ll send you a credit card statement listing each of your charges as well as any unpaid balance that carried over from the previous month, and then they’ll then offer you payment options. On the high end you can opt to settle all of your outstanding charges by paying your credit card balance in full. On the low end you can make the “minimum payment,” the lowest amount the credit card issuer will accept without penalizing you according to the terms of your credit agreement. Finally, if you can’t pay off your credit card in full but you can make more than the minimum payment then you are free to do so.

Some credit cards will charge you interest starting from the time you make a purchase (I’m not a big fan of these credit cards). Fortunately, however, most credit cards won’t charge you interest (or “finance charges”) on your purchases as long as you pay your monthly balance in full and on time and you don’t have any carryover charges from the previous month. Said another way, credit card charges are generally interest free as long as you pay your balance in full and on time. Related Article: Improve Your Credit In 5 Easy Steps.

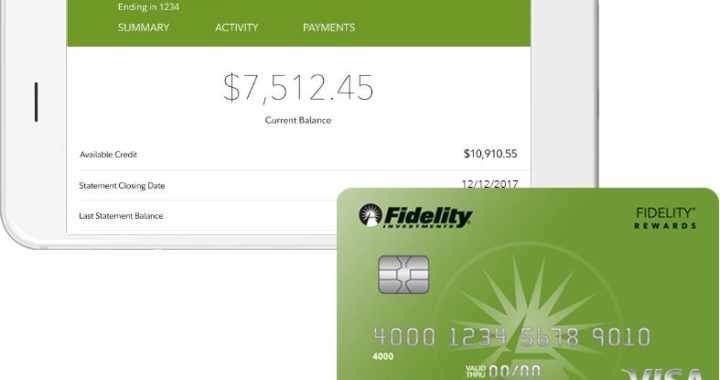

Credit Limits

Your credit limit is the maximum amount of debt that you can charge to your credit card. For example, if you have a credit limit of $5,000 then you can either make a one-time purchase of $5,000 or you can make a combination of smaller purchases equal to the same amount. You’re said to have “maxed out” a credit card when you reach your credit limit, meaning that you can no longer make any purchases with it until you’ve paid down your balance. In other words, if you charge $5,000 one month and then pay your balance down to $4,000 then you charge another $1,000 until you reached your $5,000 credit limit.

Your credit limit is the maximum amount of debt that you can charge to your credit card. For example, if you have a credit limit of $5,000 then you can either make a one-time purchase of $5,000 or you can make a combination of smaller purchases equal to the same amount. You’re said to have “maxed out” a credit card when you reach your credit limit, meaning that you can no longer make any purchases with it until you’ve paid down your balance. In other words, if you charge $5,000 one month and then pay your balance down to $4,000 then you charge another $1,000 until you reached your $5,000 credit limit.

Sometimes your credit limit is automatically set by the credit card issuer. For example, they might say, “Here’s a credit card and, based on your salary, credit history, etc., you can charge up to $5,000.” Alternatively, you can ask for a certain credit limit when you apply for your credit card (or you can ask for the credit limit to be increased for a card you already have). Either way, you should not make purchases that would exceed your credit limit.

What happens if you do exceed your credit limit? First of all, you may not be allowed to in the first place. Remember, whenever you buy something with a credit card it’s run through a payment processor (or it will be verified online if you’re making an Internet purchase). Thus if you attempt to exceed your credit limit your purchase may be denied. However, if you do happen to make charges that exceed your credit limit then your credit card issuer will likely charge you penalties for doing so.

Cash Advances

In a typical credit card transaction you’re paying for things, but you never actually take possession of any cash. For example, if you use a credit card to buy a computer for $1,000 you never take physical possession of the $1,000; that money is paid directly by the credit card issuer to the computer vendor. However, in addition to using a credit card to charge purchases, you can use it to get a cash advance. This can be accomplished in one of three ways.

- You can use your credit card to get cash from an ATM (contact your credit card company if you don’t know your card’s PIN).

- If your credit card was issued by a nearby bank you then you can go to one of their branches in person and get cash directly from a bank teller who will charge it to your credit card.

- Finally, you can get a cash advance from your bank in the form of a cashier’s check (but again, it has to be the bank that issued the credit card).

Benefits – How Do Credit Cards Work With Cash Advances?

The benefits of the first two options are obvious; you can use your credit card to actually get cash. But why would you want to use your credit card to get a cashier’s check? To illustrate, my wife and I once had a car suddenly die on us. After some searching I found a used car that we had enough money set aside to pay for. The problem was that I couldn’t access the money immediately because it was in an investment account, and if I didn’t move quickly I was afraid we might lose the opportunity to buy the car. To solve the problem I went to the bank and got a cashier’s check and charged it against our credit card. I then used the cashier’s check to pay for the car. Finally, after the money from our investments became available a few days later I used it to immediately pay off our credit card. Thus, by using a credit card to obtain a cashier’s check we were able to move quickly on purchasing the car we wanted (which ironically turned out to be a terrible car…but that’s another story).

Try Our Free Budget Calculator

Annual Fees

How do credit cards work with annual fees? Well, some credit cards charge an annual fee and some don’t. If that’s the case then why would you ever get a credit card that has an annual fee? Generally you wouldn’t. However, some credit cards provide special benefits and incentives, and if the value of those benefits and incentives exceed the cost of the annual fee then it’s worth considering.

What’s In It For The Credit Card Issuer?

How do credit cards work for the credit card issuer? To have a balanced understanding of credit cards it’s important to know what’s in all of this for the credit card issuer. Well, if you carry a balance on your credit card then it’s pretty obvious: they’re going to make a financial return of 18%-22% on the money they loaned to you. Ouch! But what if you pay your balance in full and on time every month and you never owe any interest? Does that seem too good to be true? Are you ripping off your credit card issuer, or is it just that they’re lulling you to sleep, waiting to hit you with some hidden fee or penalty?

Well rest easy, because your credit card issuer is making money when you use your credit card whether you carry a balance or not. How? For every purchase you make the merchant has to pay about 1%-3% in credit card fees (and sometimes even more on top of that). As a result, as long as you use your credit card responsibly and pay your balance in full and on time then both you and your credit card issuer are getting something out of the deal: you get a safe, convenient means to borrow money in the short term and they get steady fees from merchants when you make purchases. It’s when you carry a balance that things get out of whack, because then you’ll pay exceptionally high interest rates, and if you fall behind then a whole train of penalties and interest will follow as well.