Click Here For Credit Card Payoff Calculator Tutorial Walk-Through Below

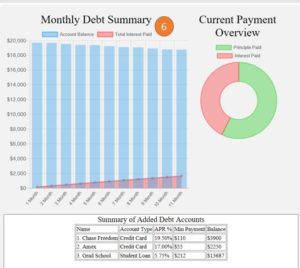

| Name | Account Type | APR % | Min Payment | Balance |

Make sure to add highest APR first

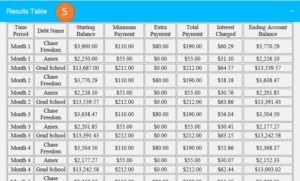

| Time Period | Debt Name | Starting Balance | Minimum Payment | Extra Payment | Total Payment | Interest Charged | Ending Account Balance |

Online Debt Payoff Calculator Tutorial

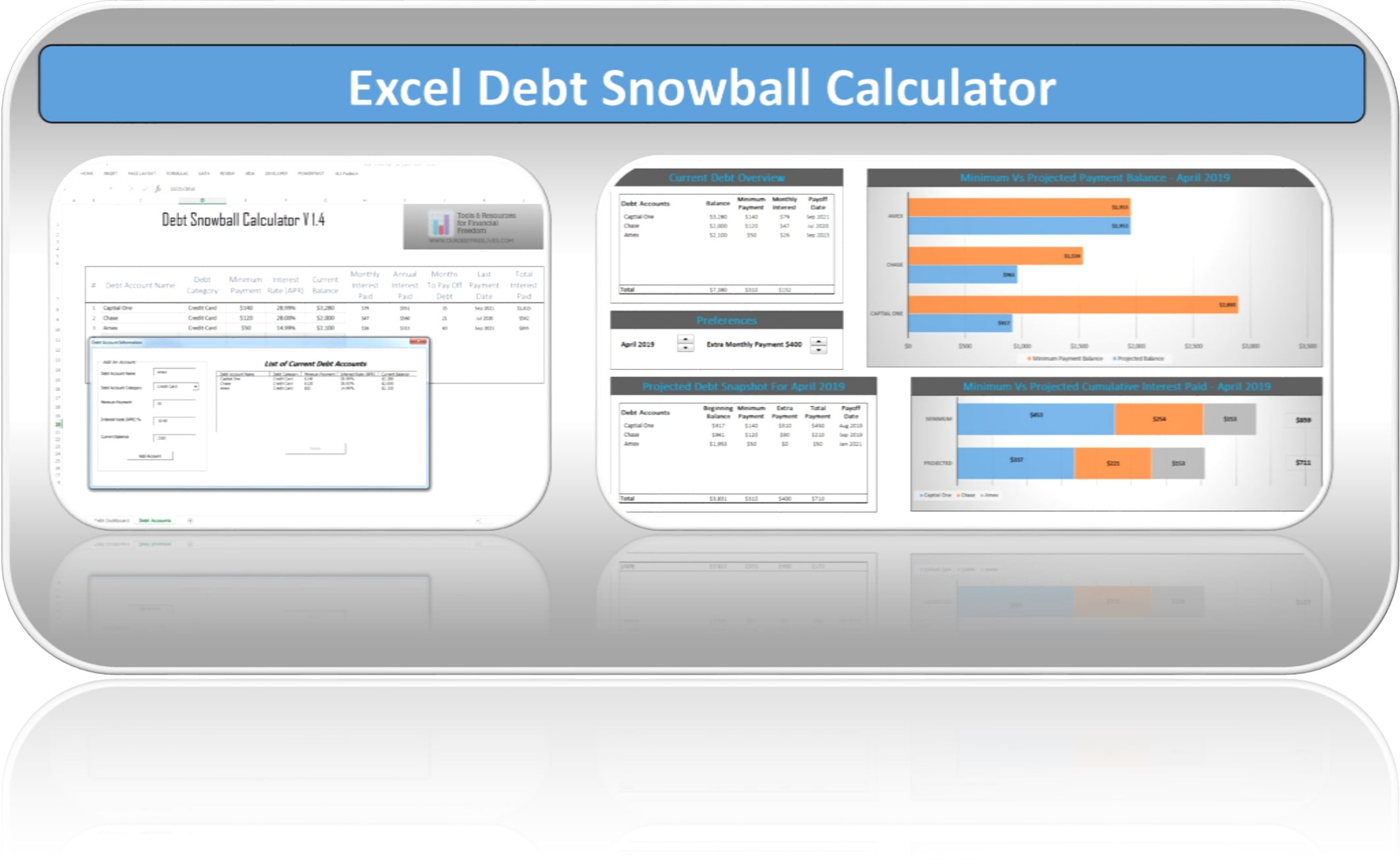

- Start off by enter all of your debt accounts in order from highest APR to lowest APR.Account Name: This can be whatever you want to call the debt account.

- Account Type: Select the type of debt.

Steps 3 & 4

- APR %: The annualized percentage rate

- Minimum Payment: For installment loans such as car loans, you will just use your monthly payment.

- Balance: The current balance of that debt account.

enter.

- Account Type: Select the type of debt.

2. Click the Add Account button. After clicking the button you'll see the information you've entered has been added to the Summary of Added Debt Accounts. Repeat step one until all of your debt accounts have been added.

3. After completing step 2 you'll have the option to add an extra monthly payment to be applied towards your debt. Next the Results Table Display allows you to select how many months you want the Results table to display.

4. Click The Run Calculator Button.

5. If you expand the results table you'll be able to see a break down of your debt reduction plan. *If you want to copy to excel. Highlight the table and click copy. Then open excel and click paste.

6. The dashboard will now display an overview of the information you enter.