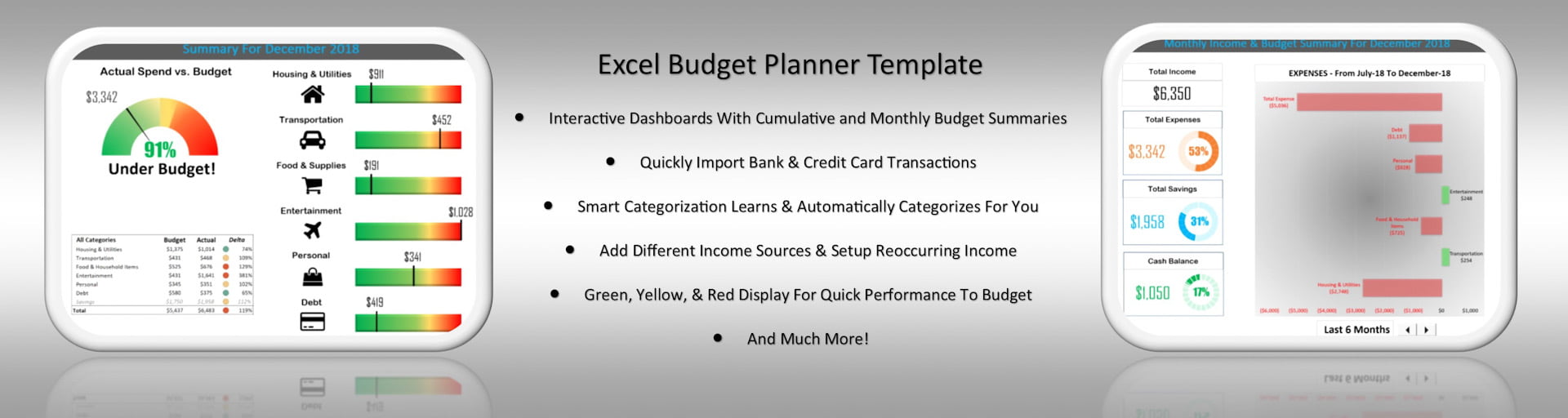

Excel Budget Planner Template

Take control of your personal finance with our Microsoft excel monthly budget spreadsheet. Our Excel budget planner book worksheet has a number of different features to help you better manage your income and expenses. The excel budget calculator has a built in monthly budget template to help you come up with a personal budget that aligns with your long term goals. This works well with our debt snowball worksheet, which can help you payoff your debt, while saving you money.

The budget excel template is great for anyone who is new to budgeting or wants to improve their financial situation. We created this excel budget template to allow you to quickly create a budget, categorize spend, and achieve your financial goals with minimal time and effort. The budget planner template has builtin flexibility, which allows you to use it as a business budget or family budget planner. Here are some of the features of the excel personal budget template with a link to download the best excel budget template.

Why Is Our Excel Budget Spreadsheet Superior?

If you’ve searched the internet for excel budgeting tools, you’ll find quite a few different monthly budget planners. Most of them do a great job creating a budget, but do a very poor job when it comes to entering & tracking your expenses. Another problem is they aren’t user friendly and can become complex very quickly. These are the very reasons why most individuals decide not to create and track their budget. This is why finding the right budget excel template is so important.

Our excel budget spreadsheet has been designed to make this process as easy and quick as possible. With our excel budget planner allows you to upload your credit card, checking account, and savings account data right into the tool. With each upload our budget planner learns the way you categorize and will automatically categorize your 100’s or 1000’s of transactions from your credit card, checking account, and savings account, so you’ll spend less and less time each month. Our average user spends less than 10 minutes a month (based on an average of 227 transactions) updating their budget spreadsheet.

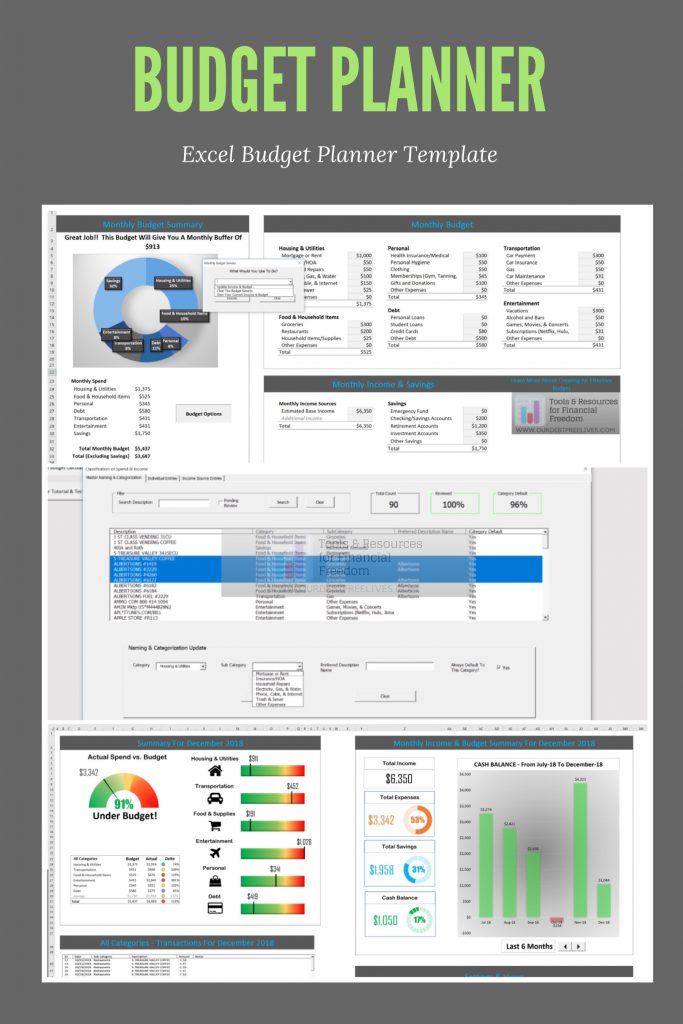

Excel Monthly Budget Template

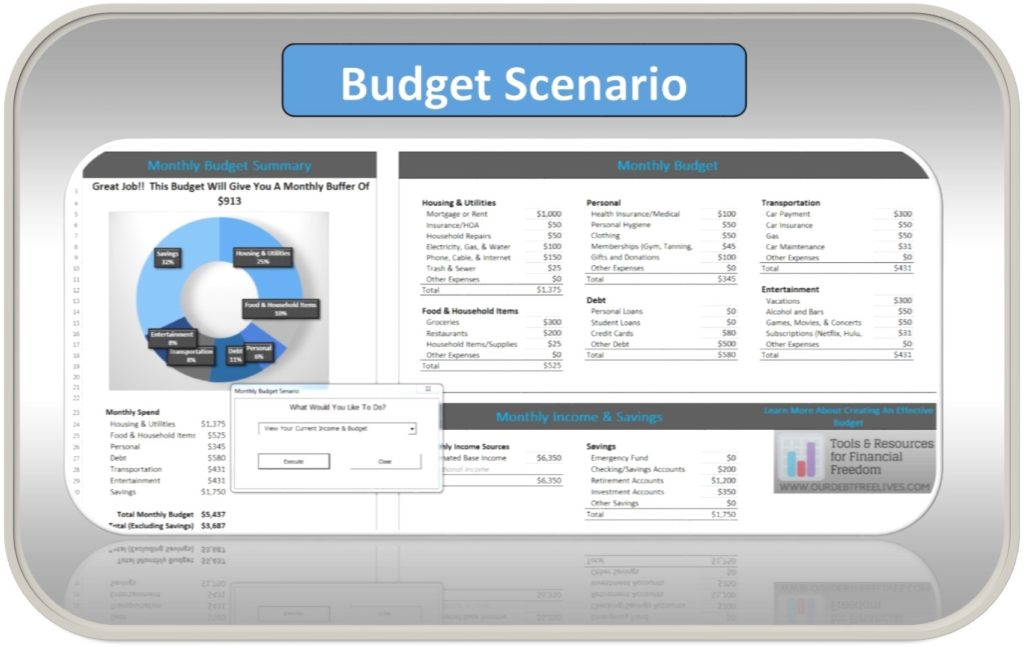

- Budget Scenario To Create A Personal Budget

- Categories and Sub-Categories Already Broken Out

- Simple Budget Breakout By Category

- Helps You Create A Budget By Telling You If Your Budget Is Too High Based Off Your Income

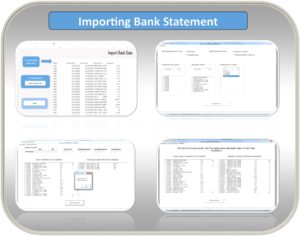

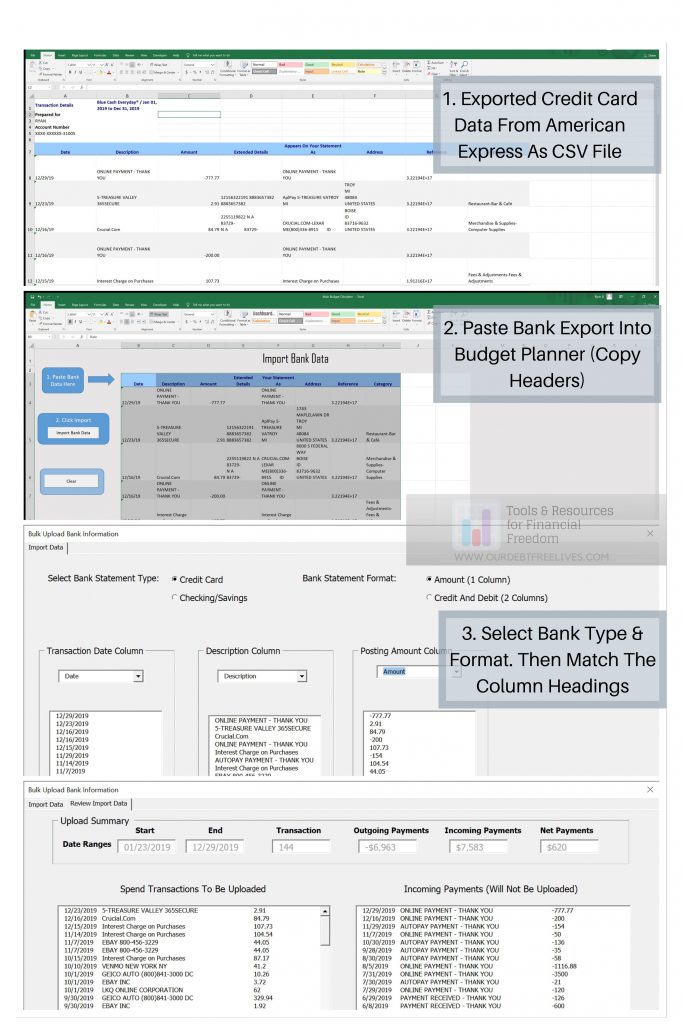

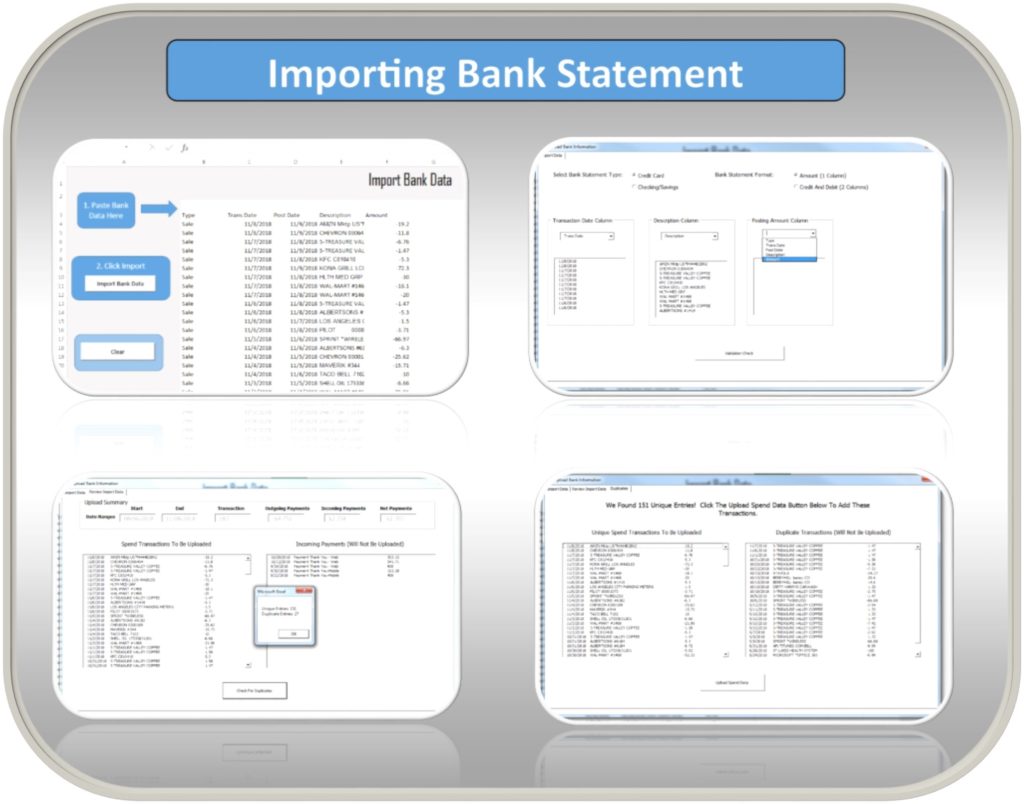

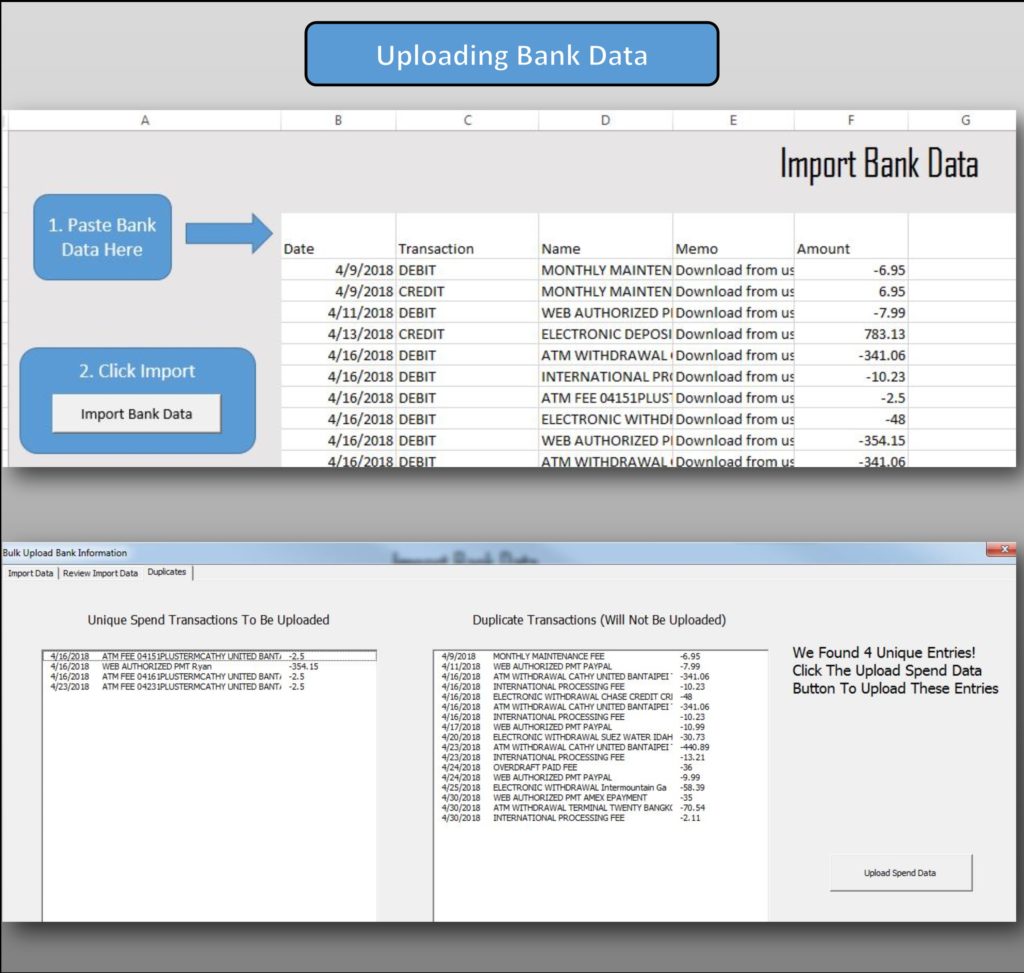

Import – Quickly Import Bank Data

- Quickly Upload Your Bank Statements

- Visit Your Financial Institution and Download All Recent Transactions as Excel or CVS

- Simply Copy & Paste Your Transactions Into the Tool

- Works On Check/Savings/Credit Card statements and More

- Summarizes All of Your Transactions

- The Excel Budgeting Worksheet Will Find and Remove All Duplicate Entries

- No More Worrying About What Dates You’ve Already Pulled

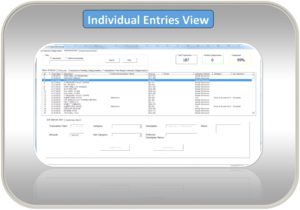

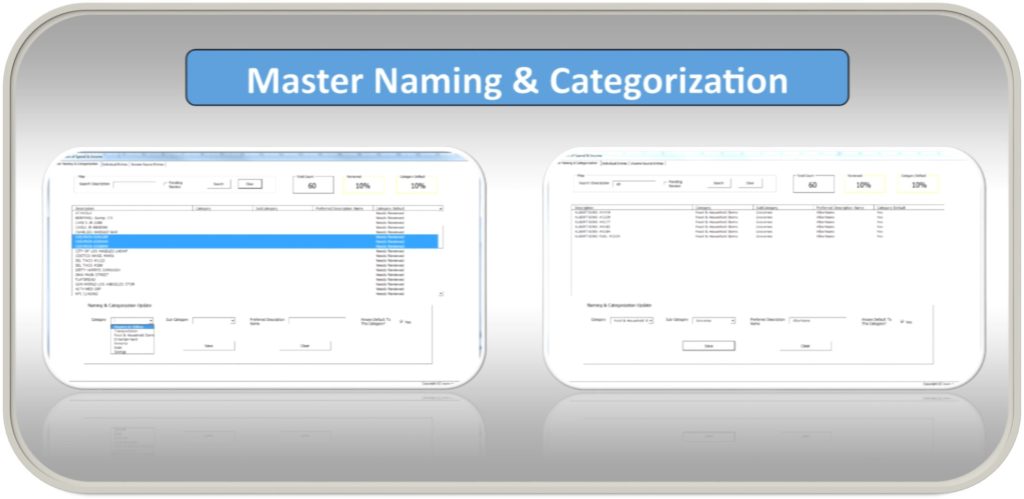

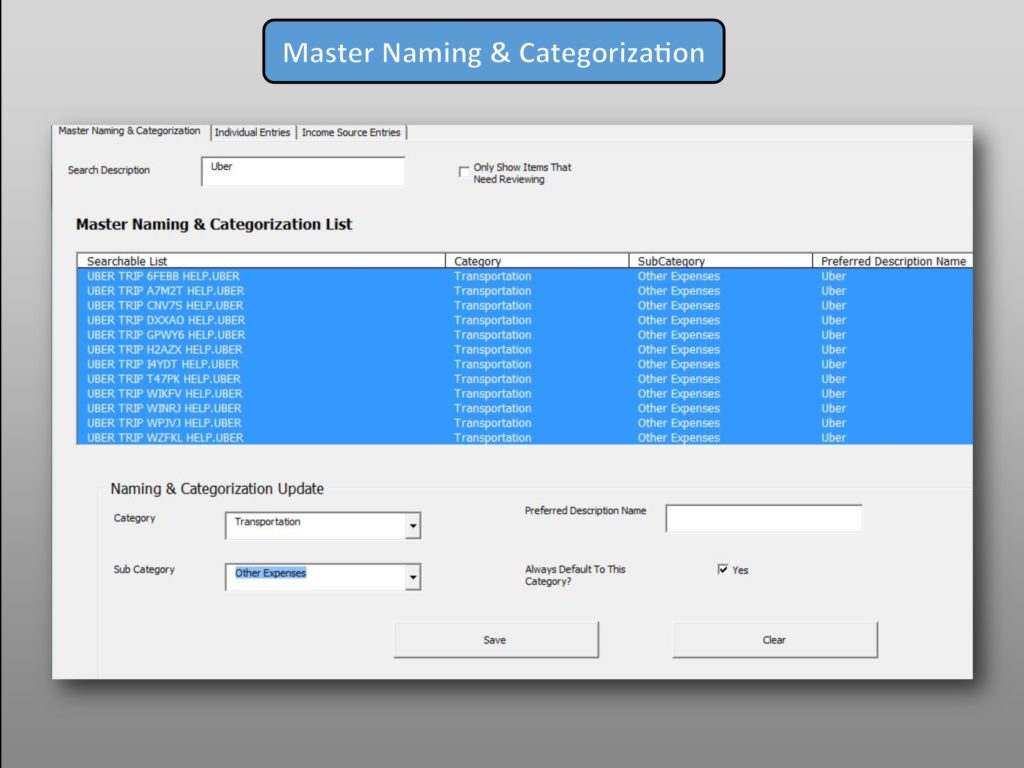

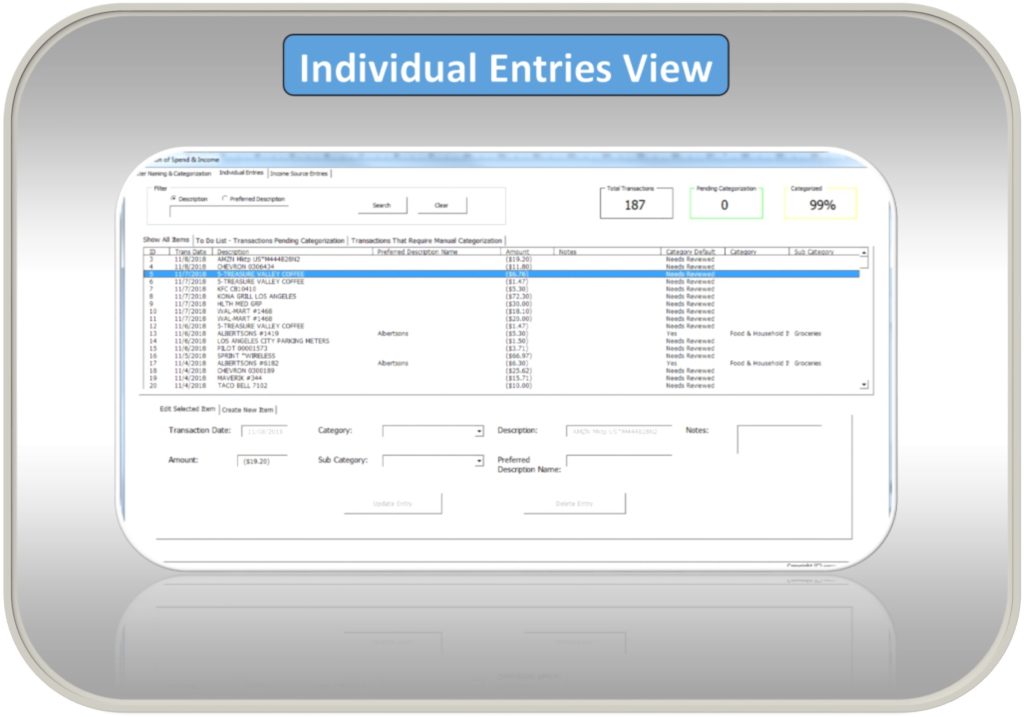

Categorization – Quick & Efficient Categorization

- The Excel Budget Template Has a Master Spend Categorization For All Import Bank Data

- Allows You To Search & Select Multiple Descriptions At The Same Time

- As Time Goes On Your Imported Spend Will Be Automatically Categorized

- Allows You To Enter A Preferred Description Name

- Example: “Whole Foods #43 LOS ANGELES, CA”, “Whole Foods #41 LOS ANGELES, CA”

- Instead Of Seeing Variation of The Same A Preferred Description Name Can Be Used.

- Example: “Whole Foods”

- Categorize Multiple Items At The Same Time

- Displays Categorization Progress % & Turns Green After Categorization Has Been Completed To Let You Know You’re Finished

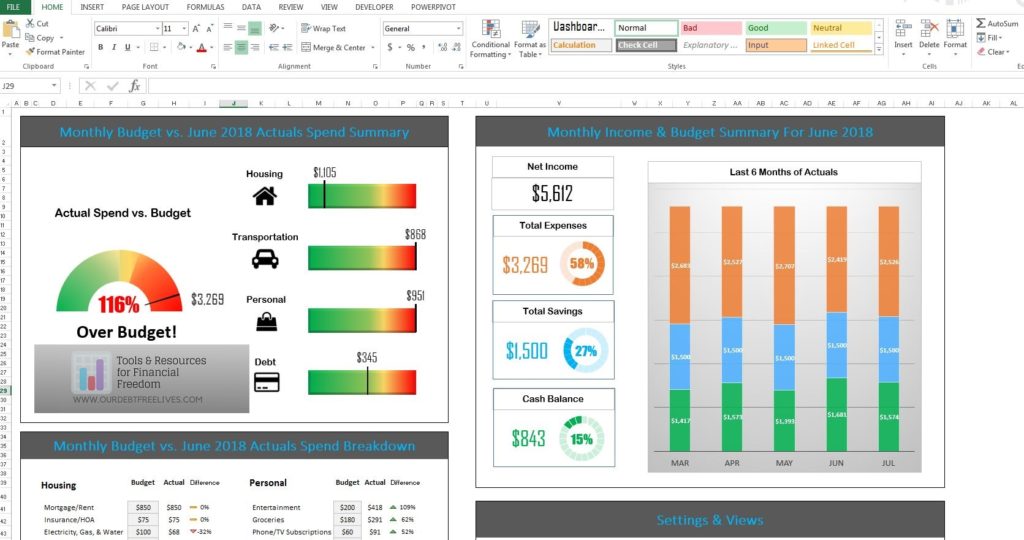

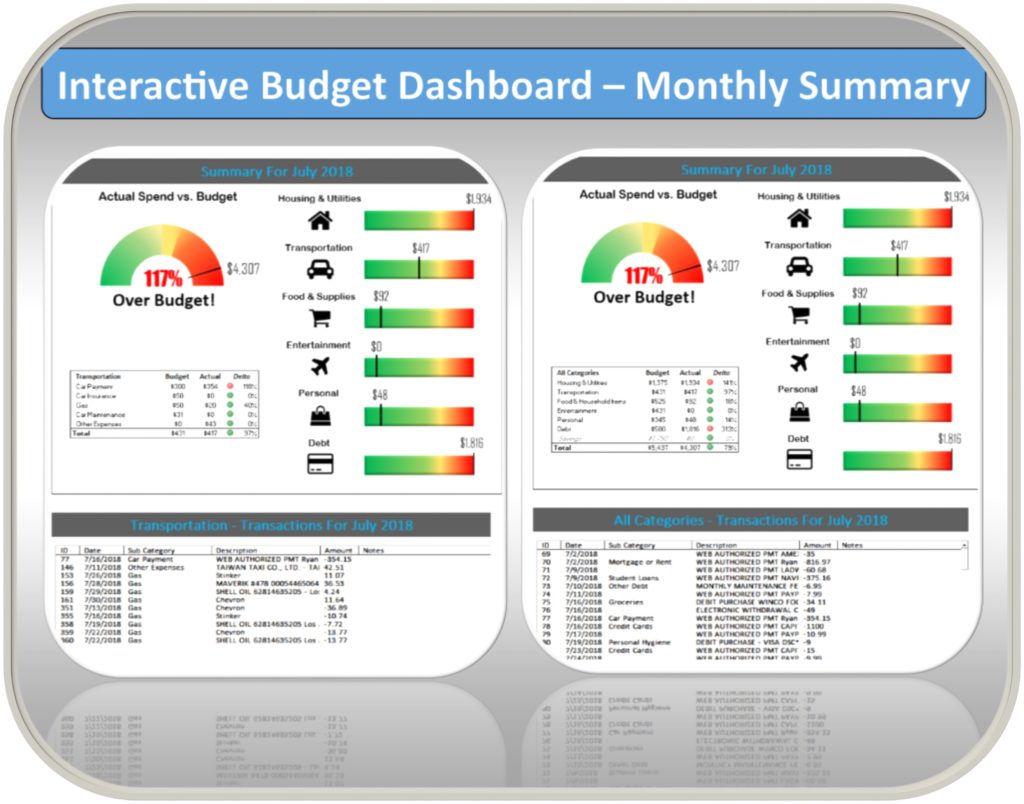

Dashboard – Monthly Budget Summary

- Interactive Monthly Summary Dashboard

- Gauge Shows Overall Performance To Plan

- Clicking On Any Category To Get A Break-down Of Sub-Categories Performance

- Green, Yellow, & Red Display Allows You To Quickly Identify Performance To Budget

- All Monthly Transactions Are Added Below (When Sub-Category Is Clicked Only Transactions Under That Category Will Display)

- And Much More!

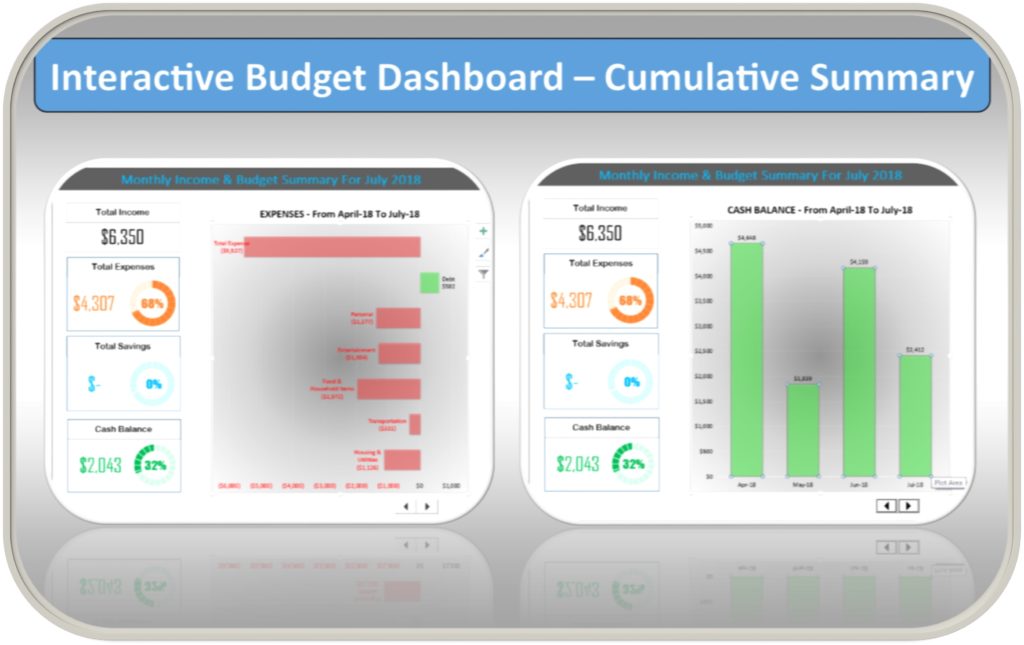

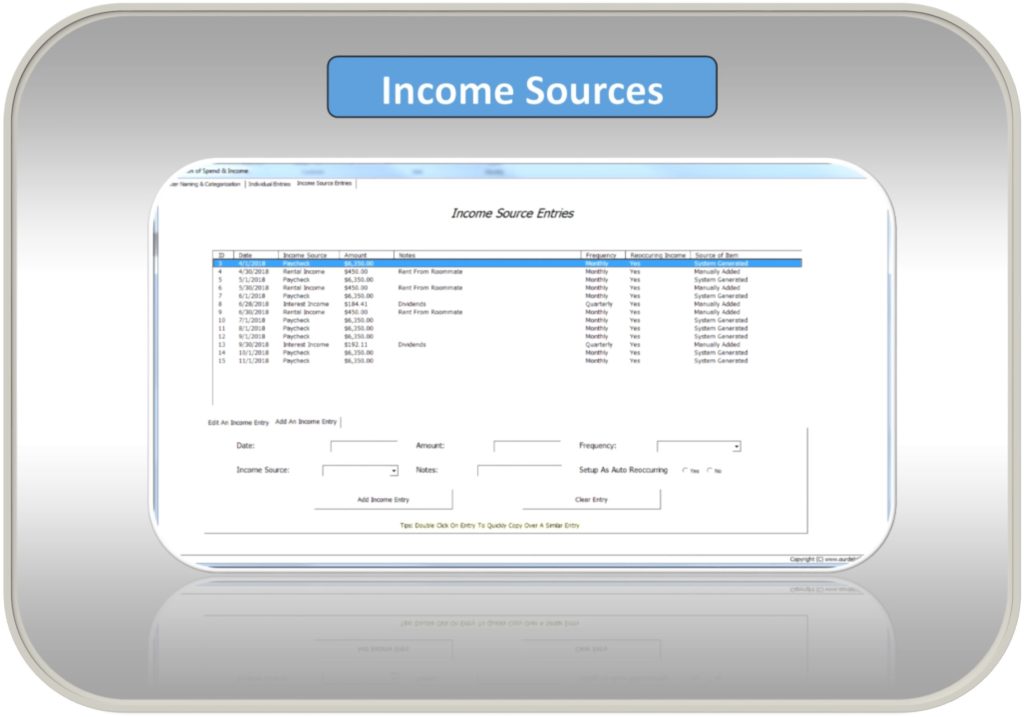

Interactive Budget Spreadsheet Template Dashboard – Cumulative Summary

- This Dashboard Allows You To See Income, Total Expense, Savings, & Cash Balance In A Cumulative View

- Easily Change The Cumulative Time Period That’s Shown With A Click Of A Button (Yearly Budget Viewing)

- Income: Displays & Labels All Income Sources

- Total Expense: Displays All 7 Categories To Normalize Performance Of Spends Vs. Budget

- Example: Having A Monthly Budget of $100 For Car Insurance. If You Pay $580 Every 6 Months Looking At The Monthly View You’ll Always Be Way Over Or At $0. Using The Cumulative View Your Able To See Your Performance Over A Period Of Time.

- Total Savings: This Displays & Labels All Savings Sources

- Cash Balance: Shows Your Cash Flow After All Expenses & Savings Have Been Accounted For.

Get Started On Achieving Your Financial Goals!

Did you know 82% of individuals with a net worth of $500k+ have a budget(https://www.bea.gov/system/files/2019-12/All-Chapters.pdf). This just goes to show how important having a budget. Creating a budget allows you to plan for your financial future, whether it be planning for retirement or paying off debt. Are you ready to reach your financial goals? Start by downloading our excel budget spreadsheet today! Click To Download The Excel Budget Planner!