Quickly & Easily Assess Your Financial Situation With Our Calculator

| Account Type | APR % | Minimum Payment | Account Balance |

Calculator Tutorial (User Input) - Quickly & Easily Assess Your Financial Situation

- Start off by adding all of your debt accounts

- Account Type: Credit Card, Student Loans, Auto Loans, & Personal Loans.

- APR %: Annual Percent Rate (APR) or called annual interest rate is the percentage of interest your pay. Note: usually ranges between 3%-29%

- Minimum Payment: Enter the minimum payment or the installment payment. Note: Use the fixed monthly payment for installment debt (car loans, student loans, personals loans...)

- Balance: Enter the current balance of the debt.

- Click "Add Account" & repeat step 1 until all of your debt accounts have been added

- After your click "Add Account" a summary of the accounts you've added will display.

- Select your monthly net income

- Monthly Net Income: Includes all income sources after tax and deductions

- Click the update button to display the updated dashboard

Calculator Tutorial (Dashboard) - Quickly & Easily Assess Your Financial Situation

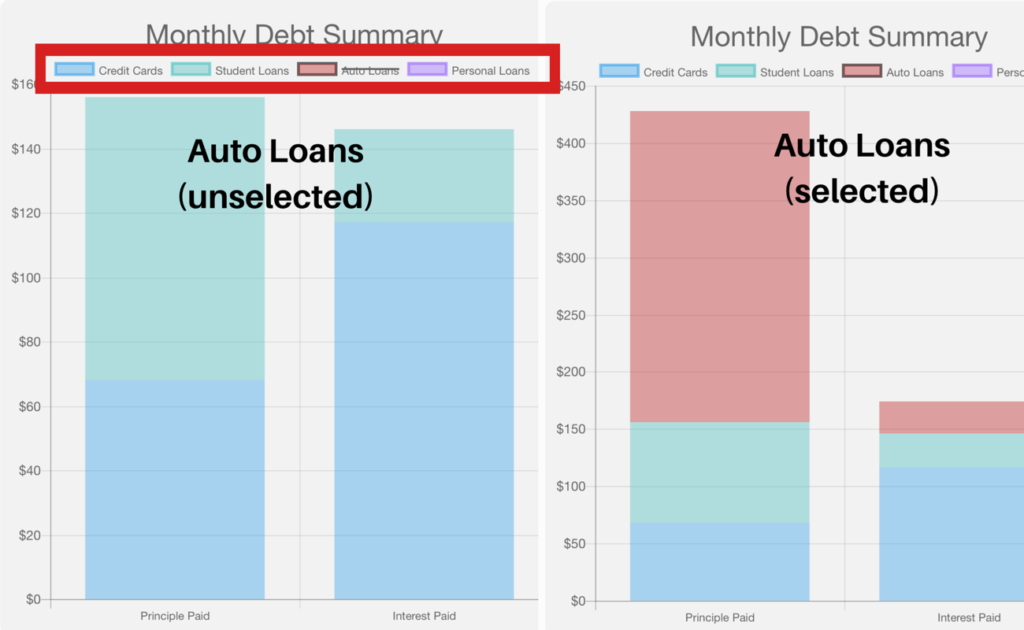

Monthly Debt Summary:

- The chart will have a summarized monthly view broken out into two bars list "Principle Paid" & "Interest Paid".

- Principle Paid: Is the amount of your payment that was actually applied towards your debt.

- Interest Paid: Is the amount of your payment that went towards paying interest and does NOT go towards paying off your debt.

- Interactive Features:

- By clicking on a category in the legend you will be able to remove it from the graph. The graph will automatically update. To bring a category back simply click again on the category and the category will display again.

Debt To Income Ratio:

- The debt to income is calculated by taking a cumulative total of all minimum payments and diving that by your monthly net income.

- Debt To Income Scoring:

- GOOD 0-6% : Having a little bit of debt is okay, and can be healthy for your credit score.

- AVERAGE 7%-14%: You may want to consider looking at payoff some of your debt if you have high interest rates (APR above 10%).

- BAD 15%+: Having a high debt to income ratio decreases your financial independence. By coming up with an budget and a debt reduction plan you can be on your way to improving your financial situation. The debt snowball calculator is a great tool that will create a customized plan to pay off your debt as quickly and efficiently as possible (see below for recommendations).

Average APR (Annual Percentage Rate)

- The Average APR is calculated by taking the total monthly interest paid and dividing it by the total debt balance.

- IMPORTANT NOTE: This score should be used in conjunction with your debt to income score. Having a low high debt to income ratio, but having a low average APR is not necessarily a good thing. This just means you still have a large financial obligation, but at a lower interest rate.

- Average APR Scoring:

- GOOD 0-4%: This means most of your debt is most likely secured debt (such as auto loans), instead of unsecured debt (credit cards).

- AVERAGE 5-10%: Depending on your debt to income ratio you may way to look at paying down the debt with the highest interest rates.

- BAD 11%+: You debt most likely is coming from credit cards or your credit score might have been low when you took out loans. In either case you should consider coming up with a plan to pay down these debts (see below for recommendations).

Tips on How To Decrease Your Debts & Interest Rates

1. Individuals With A Good Credit Score

Consider refinancing your debt or applying for credit cards that offer balance transfer with an introductory rate of 0%. This is a great strategy, if you plan to pay down your debt and NOT increase spending.

Example: You have a credit card with a balance of $3,500 at an APR of 29.99% and you plan to pay that off in one year. Currently, each month you are paying $67.47 in interest (assuming balance remains the same). Now let's say you applied for a credit card with an introductory rate of 0% for the next 12 months. If you transferred the balance to the new credit card you would be savings yourself $594!

2. Individuals With A Low Credit Score

Feeling overwhelmed with debt? Well, you aren't the only one. In fact, according to Experian at the start of 2018 the average American was carrying $6,375 of credit card debt(¹). For this reason we've creating an Excel based debt snowball calculator that will automatically create a recommend debt relief plan that shows you how to pay off debt fast.

Debt Relief Tool - How To Pay Off Debt Fast?

This debt reduction plan is intended to focus on the shorter term debt such as: credit cards, auto loans, and personal loans. We don't recommending using student loans and or mortgages (unless you have less than 5 year left). Before using this tool, we recommend first creating a budget to understand how much each month you can apply towards your debt.

Resources:

(¹) https://www.cnbc.com/2018/01/23/credit-card-debt-hits-record-high.html