Most Recent Investing Videos

Investing For Beginners

3 Questions to Carefully Consider Before Investing

Before investing in mutual funds, stocks, bonds, real estate, commodities, or anything else, it’s important that you’ve carefully considered the following 3 questions. Do you have the means to invest? Do you truly have a willingness to invest? Do you really know how to invest wisely and effectively? If you don’t have a satisfactory answer for each of these questions then […]

What Are Index Funds? Index Funds Vs. Mutual Funds

You may consider them boring, but index funds are low-cost, low-maintenance funds designed to grow wealth at a slow and steady pace. An index fund is a type of mutual fund that tracks the price fluctuations of larger indexes such as the Dow Jones Industrial Average and the S&P 500. Putting your money in an index fund is a […]

Best Brokerage Firms

The internet has changed the game for stock trading, as it is now possible for the casual investor to trade stocks without the need for a personal stock broker. Do-it-yourself investing is here to stay. The problem is wading through the many discount online stock brokers to find the best. While the long-established and well-respected […]

Target Date Funds: Will Your Funds Hit Their Target?

A Target Date fund is a type of investment, usually a mutual fund, that is designed to provide a simple investment solution through a portfolio in which the investing strategies become more conservative as the target date (usually retirement) approaches. Target Date funds have become increasingly popular with 401(k) plan investors and managers. While many people appreciate the […]

Short Term vs Long Term Capital Gains

When you make money on an investment, it is called a capital gain. Here in the U.S., we are taxed on capital gains. It is worth noting, though, that you aren’t taxed on the gain until you actually realize it. That is, you aren’t taxed until you sell and the investment earnings are yours. When you sell […]

How Do Mutual Funds Work

So how do mutual funds work? Well, mutual funds are a type of communal investment that gathers money together from numerous different investors to purchase stocks, bonds, and other securities on a larger scale than what an individual investor could afford independently. When you contribute money to a mutual fund, you get a stake in […]

Financial Risk Tolerance vs. Emotional Risk Tolerance

One of the terms that you might have heard when you are getting ready to invest is “risk tolerance.” As you might imagine, this term refers to the amount of risk you can handle when you invest. As you evaluate potential investments, it’s a good idea to take some time to review your risk tolerance. For the […]

Stock Valuation – How To Value A Company

Stock Valuation – The Relationship Between A Company’s Stock Price and Cash In another article titled Companies To Invest In, I made the point that, at its core, a well-run company is simply a money making machine. That concept – that the value of a company is ultimately tied to cash – is one of the […]

Companies To Invest In – 3 Principles To Follow

Investing means giving up some of your money now with the expectation of getting even more money in return in the future. Did you catch that? Money. Investing is about money. The bottom line when it comes to investing in stock (or anything else for that matter) is that you want a company that can […]

Retirement Account Basics

Retirement Mistakes To Avoid When Investing In An IRA

An IRA retirement account is one of several critical pieces of planning for retirement. Millions of Americans have an account how they contribute to. If you can be eligible for an account, contributions ought that they are made consistently, each and every year. This stands out as the easiest solution to financially plan on your […]

Roth IRA Definition

Want to get started down the right retirement road? One of the best things you can do today to improve your chances of a comfortable retirement is to open a Roth IRA and start contributing regularly (automatically, if you can) to a diverse set of investments. The Roth IRA is not an investment though, like […]

Traditional IRA vs Roth IRA – Understanding The Difference

It’s good to invest for retirement. It’s even better to invest for retirement if you can also pay less in taxes during the process. That’s what the traditional and Roth IRA provide. They allow you to pay fewer taxes. But they have a few differences, which I will explain below. The federal government has decided […]

Can You Contribute to a Roth IRA and 401K?

Can you contribute to a Roth IRA and 401k? Yes, you can contribute to a Roth IRA and 401K at the same time. In this post I’ll share my experience of simultaneously contributing to a Roth IRA and 401K, as well as the requirements you’ll need to meet in order to do the same. When […]

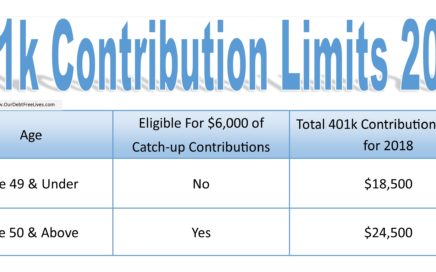

401k Contribution Limits 2018 & Catch-up Retirement Plan Limits

Everything you need to know about your 401k contribution Limits 2018. Most families don’t have the advantage of multiple tax sheltering opportunities. A small business, a farm, or nine children are available to only a few, so tax reducing techniques may difficult to come by. As a result, perhaps the single greatest tax sheltering device […]

Fidelity 401k Loan – Everything You Need To Know

For many when starting their new job thought of participating in a 401k plan was exciting. A place to store thousands and thousands of dollars, safe and secure, awaiting retirement. Then life happened. The transmission went out. Your son broke his arm. The tree fell onto the house. And that was just last month! Now […]

401k Distribution Rules – Everything You need to Know

401k Distribution Rules As you read thru this article keep something in mind………the IRS has permitted tax benefits to families by way of the 401k for many years. Primarily intended to permit individuals to salt away extra cash for their own retirement, participants have responded. 401k plans now make up the largest employer-sponsored retirement account […]

Early Retirement Advice

Early Departures…… The most recent economic situation is making it increasingly difficult to even discuss the idea planning for an early retirement. Much less, actually doing it. Still, it’s always a good time to plan for retirement no matter what the age. First things first. The key to making sure that retiring early actually works […]

Safe Harbor 401k Plan

A safe harbor 401k plan is a unique type of retirement plan with two significant differences from a traditional 401k plan. One, it requires mandatory employer contributions to employee accounts. Second, it gives an employer an ability to offer a 401k plan to employees without any required discrimination testing. The Safe Harbor 401k plan permits […]

HSA Rules For Employer Contributions

Health Savings Account Issues for Employers and Employees HSA Rules For Employer Contributions Must Be Fair for Employees! First, and perhaps most importantly, employer need to know that HSA rules require that contributions to employees must be “comparable” for all employees participating in the HSA. If they are not comparable, or fair in terms of the IRS […]

Small Business SEP IRA Rules

Is an SEP IRA plan right for you? A SEP Plan is a small business retirement plan that allows employees to save for their retirement. It is designed to give employers of companies with few or no employees an easy alternative to building for retirement. Any business may establish a SEP Retirement Plan. Knowing the […]

Using 401k For Down Payment – Is It Right For You?

After adding money to your 401k plan over several years, you may have built up a lot of money inside your 401k accounts. These accounts could be a desirable supply of funds for investing in a home. Nevertheless, there tend to be rules as well as restrictions upon withdrawals from the 401k accounts. Fortunately, there […]

Rollover 401k to IRA?

What do I need to figure out before I decide on initiating a rollover 401k to IRA? There are many factors involved before deciding on rolling over your 401k into an IRA. 4 Things To Know Before You Rollover 401k to IRA 1. What are the fees involved in keeping the 401k plan or rolling […]

Should I invest in my Company Sponsored 401K Retirement Plan?

Should I invest in my Company Sponsored 401K Retirement Plan? Should I invest in my company’s 401k plan? The answer is YES!!! Take advantage of your company sponsored 401k retirement plan. Government programs for retirement income, like social security, are becoming very unpromising. And retirement healthcare has been so up in the air lately in […]