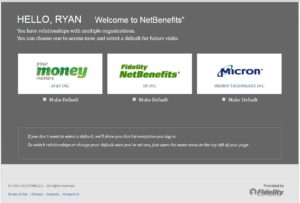

If you company provides a 401k plan there is a good chance it’s provided by Fidelity’s NetBenefits. I’m going to walk you through how to use the tool. If you haven’t logged in before check with your local HR on how to setup access to Fidelity’s 401k NetBenefits plan.

1. Logging into Fidelity NetBenefits Plan

- First you’ll want to visit https://401k.com/ or https://fidelity.com/ to login. Once you’ve logged in you make get a screen similar to the over on the right. This is because I’ve worked at three different companies that provided 401k Fidelity Netbenefits plan.

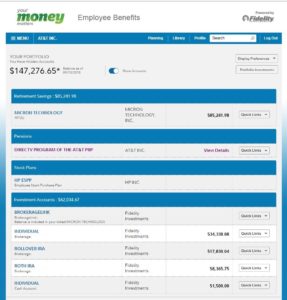

2. Fidelity Investments Account Summary

- Here you’ll find a complete list of your Fidelity Investment Accounts (includes all Fidelity retirement accounts, stock plans, pensions, non-retirement accounts, savings, and checking). We’re going to focus on the 401k Fidelity NetBenefits. I’m going to use Micron in this tutorial, because I’m still currently employed there.

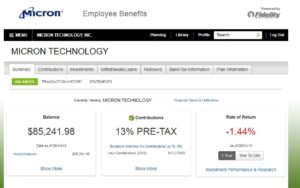

3. Checking Your 401k Balance, Contributions, and Return

- From the summary screen you can see your current 401k balance, your contribution for the year, current pre-tax percentage, your employers match(will vary between companies), and your rate of return. You should at least be contributing enough to get the full benefit of your employers match.

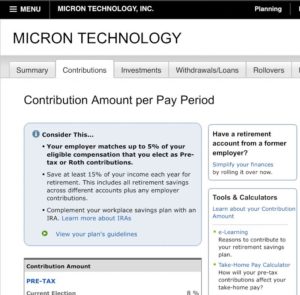

4. Contributions

- Changes to your contributions can be made here. Depending on your employers retirement program you may see Pre-Tax, ROTH, and After Tax. The Pre-Tax contributions is the same as a 401k contributions. The ROTH are going to be after-tax contributions. You can review the Roth & 401k Contribution Limits Here.

- If your employer offers a match, you’ll see the details listed as the first bullet point in the blue box. Example: “Your employer matches up to 5% of your eligible compensation that you elect as Pre-tax or Roth contributions.

5. Investments

- You have the option to change your current and/or future investment options in Fidelity Net Benefits.

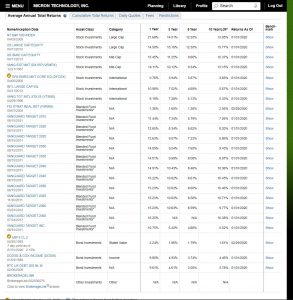

- Here you will find a list of all investment options your Fidelity NetBenefits plan offers. These will be broken our by asset class, category, and historical performance. Most plans will have target date funds. These are great for someone who doesn’t want to actively manage their retirement portfolio.

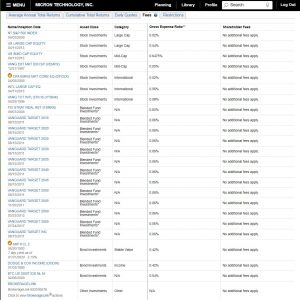

- One thing to keep in mind is the expense ratio. The fees tab will give you the expense ratio for each mutual fund. Mutual funds with a high expense ratio can reduce your return. Ideally, you would want to have an expense ratio below 0.5%.