Understanding Debt Management vs Debt Settlement

When looking at debt management vs debt settlement can be a little confusing if you do not have all the facts. You may realize you need some type of financial help, but you may not know how to get it. If you are considering either one of these programs, make sure you understand the pros and cons of each one.

Debt Management Overview

The pros of a debt management company include help organizing and paying off your current debt. When you contact a debt management company, they will help you contact creditors and come to some type of agreement to pay less money each month on your accounts. Although you will still have to pay all the money back, you may be able to negotiate less frequent harassing phone calls and letters.

Debt management services act as a go-between with you and your creditors. If you are uncomfortable talking to people on the phone, this is a great solution. Instead of feeling intimidated by pushy and sometimes obnoxious creditors, let a professional talk to them and stand up for your rights as a consumer.

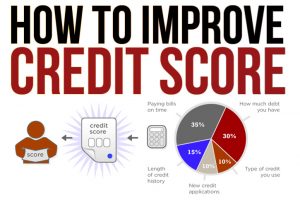

The main negative to using a debt management services is that it could affect your credit. Many lenders view the use of these types of companies in a negative manner and they may be less likely to lend money in the future. Although, if your credit is already in serious trouble, once you have gotten your debt under control, you can begin to rebuild your credit and get back on your way to financial freedom.

Debt Settlement Overview

Debt management vs debt settlement continued. There are also pros and cons to working with a debt settlement company. If you are seriously in debt, like many Americans today, you may find a debt settlement company more helpful. These professionals can help you with credit card settlement or most other types of large loans. Your debt settlement counselor will work directly with your creditors to negotiate a more manageable amount of money you will need to pay back. This is sometimes done by taking off the delinquency fees or part of the interest. Most creditors are happy to get at least a portion of the money they are owed. This is especially true with credit card settlement. Most of the money owed may be interest – so the company is not really losing out on much. Saving 40% to 60% is common with most debt settlement companies.

Another positive aspect of debt settlement is that it is fairly quick and your debt will be paid in full. If you have trouble saving money for a settlement payment, the company may also be able to help you with that. As long as you are behind on your bills, you can use these companies to help negotiate a credit card settlement or other loan payoffs quickly. If you are worried that you may have to declare bankruptcy, debt settlement is a great alternative. A bankruptcy will stay on your credit report for several years and basically says you could not pay back any of the money you borrowed. Using the settlement option, future creditors will at least see that you made an attempt to pay back the money and hopefully that you have learned your lesson about borrowing more than you can pay back.

Debt Management vs Debt Settlement Closing Thoughts

Just like the debt management companies, your credit will be affected when you use debt settlement. You also need to make sure you are using a reputable company that has your best interest in mind. Once you are out of debt, make sure you have the information you need so you do not find yourself in financial trouble again, later on.

Harassing phone calls can cause you to become depressed and even less like to make payments on your past due accounts. When you contact a debt settlement company, they will take care of the phone calls and you can get some peace and quiet and feel in control of your life again.