Why Should I Use The Excel Debt Snowball Worksheet?

On your path to becoming debt free, you need to come up with a payoff plan that allows you to pay off debt quickly. Our Excel based debt snowball calculator allows you to quickly input all of your debt and determine, which to pay off first. The reason it’s called a “snowball” is, because as you paying off one of your debt accounts, you then use that same payment amount towards the debts with the highest interest rate. This is known as the debt snowball method, because instead of spending that extra money, you use it for debt reduction. You can start to see an impact within a few months, obviously this depends on how aggressive you are. The accelerated debt payoff tool will allow you to payoff those high interest rate credit cards and put that money towards retirement.

Why Is Our Debt Snowball Calculator Superior?

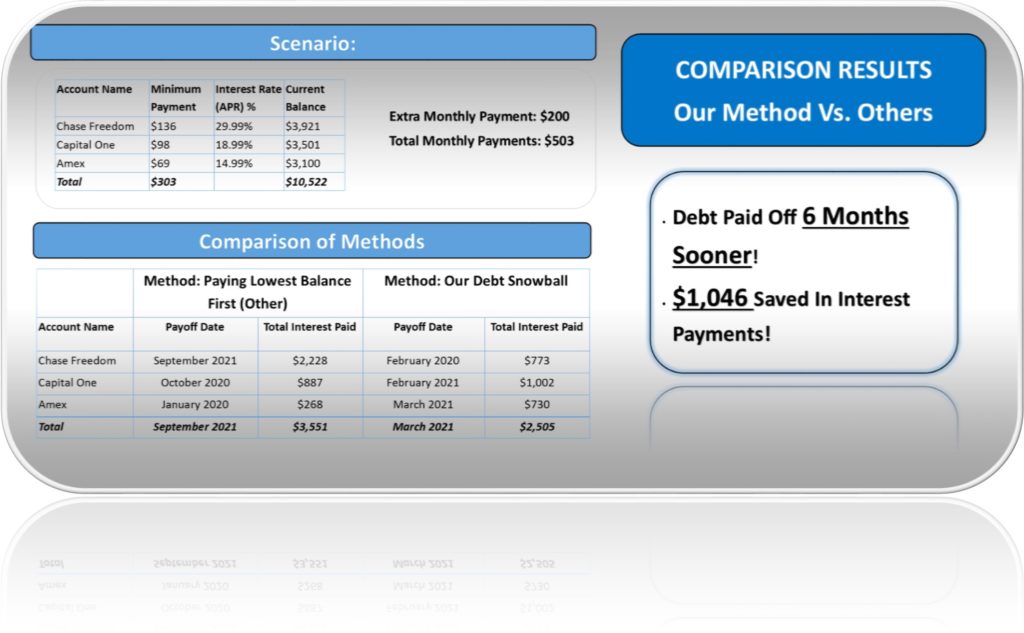

Most of the credit card payoff calculators or debt snowball spreadsheets just have you paying off the debt with the lowest balance and moving on to the next. This is the approach Dave Ramsey recommends, but by not paying your highest interest rate debt off first you will pay more in interest. This is a BIG MISTAKE that could cost you $1,000’s in extra interest. Looking at the example in the picture, you can just how big of an impact in the amount of interest you pay and how quickly you pay off your debt.

With our debt snowball calculator, we’ll tell you which debt to pay off first, while creating a customized plan that will minimize the amount you pay in interest. This excel worksheet was built for you to quickly and efficiently run 1000’s of different “what if” scenarios with just the click of a button. Our debt snowball worksheet will show you by month how much to pay and what your new ending balance will be.

Payoff Your Debt Has Never Been So Easy! Our Simple To Use Excel Debt Snowball Spreadsheet Does The Work For You!

1. Start Off By Listing Out All of Your Debts:

- The easiest way to do this is by pulling your credit report to get a list of all of your debts): Student loans, car loans, credit cards, mortgages, etc…

- Make sure to collect the following information for everyone of your debts.

- Minimum payment

- Interest Rate (ARP)

- Total Balance

2. Next Open & Input Your Debt Account In Debt Snowball Spreadsheet:

- Go to the Debt Accounts Tab and Click The “Update Debt Accounts” Button.

- Debt Account Name: Enter the name(s) of your debt account. Note: Make sure to use a different name for each debt account

- Debt Category: Select from the drop down the debt category.

- Minimum Payment: Enter the minimum payment on all debt accounts. Note: Use the fixed monthly payment for installment debt (car loans, student loans, personals loans…)

- Current Total Balance: Enter your most current balance.

- Start Date: This is the date you plan to start paying off the debt. I’d recommend using today’s date as the start date.

3. After Entering Your Debt Accounts Go To The Debt Dashboard On The Excel Debt Snowball Calculator:

- All of your debts, from the highest to the lowest balance will show up on the graph. You can see the total interest paid if you were paying only the minimum vs using the debt avalanche method.

- The accelerated debt payoff plan will put the debt in order from highest interest debt first, which is usually your credit card debt.

- Your payment schedule will display each month until all of your accounts are paid off. This will allow you know exactly what to pay on each account.

- Checkout our video for more information.

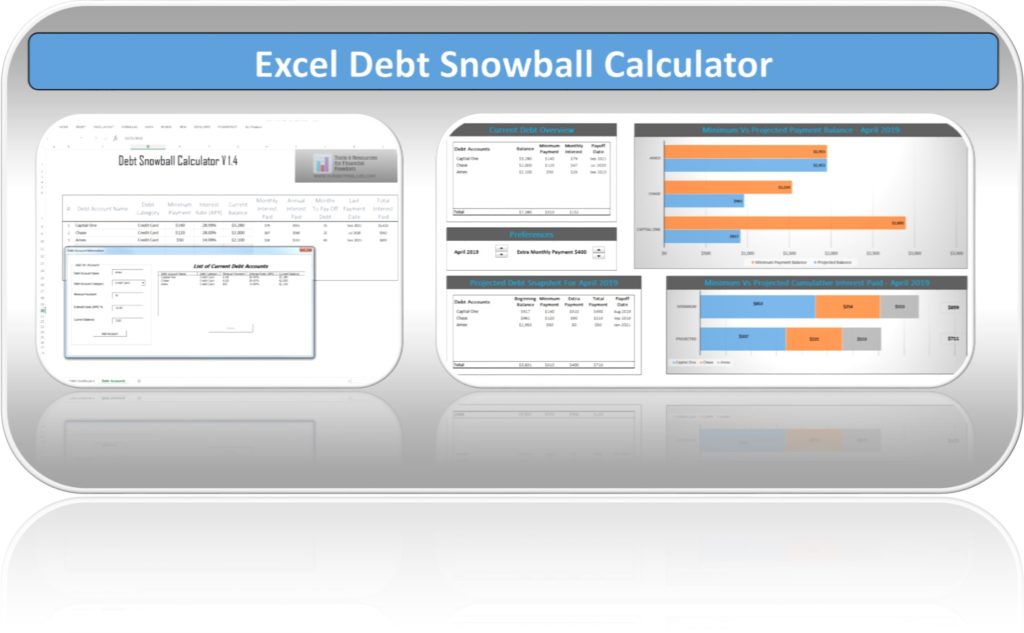

Excel Debt Snowball Calculator

Excel Debt Snowball Benefits:

- Fully AUTOMATED! NO EXCEL KNOWLEDGE REQUIRED!

- Optimizes your debt payoff schedule, to save you $100’s to $1,000’s vs similar templates

- Add up-to 18 different debt accounts

- Simulate over 10,000 different scenarios with a click

- Categories: Credit Cards, Student Loans, Auto Loans, Personal Loans, Mortgage, Medical and more

- Interactive dashboard with custom built views

- Created by Finance Professional

Tips To Maximize Success With Debt Snowball Plan

- Think about creating a budget. By creating a spending plan for your money, you’ll be insuring that you have enough money to cover your other expenses and paying down your debt. This will also help you better understand your current spending habits and identity areas were you can cut back.

- Look for areas to cut back on spending and apply that towards your debt. Even small amounts can add up quick. For example, if you cut your spending back by $2 a day, you’d saved $60 a month, and $720 over a year.

- Individual with average to good should consider opening a new credit card with an introductory rate of 0% APR. Balance transfer credit card: by transferring the balance from a high interest rate credit card over to the 0% card, you can be saving $100s.

- Once you’ve decided a debt reduction and how much money you’ll apply towards your debt, make sure to keep track of your progress against your debt reduction plan. The debt snowball calculator will have a breakdown for each month of what amount you need to pay. By tracking your current debt situation, you’ll be able to see your progress. As time goes on you may have changes in monthly expense or income, at this time you may consider re-evaluating your plan.

Get Started On Your Path To Becoming Debt Free!

Now it’s time to start paying off your debt! Remember that for every extra dollar you apply towards your debt will save you money in interest payments. After paying off your first debt, you’ll want to begin paying off the next recommended debt. Do this until this one is paid off. Now continue this process until all debts are paid off. The idea is to make being debt free apart of your life. This will help your towards becoming financial independent!