Managing your funds well throughout these times is of utmost relevance. Individuals are having a hard time making ends consult the raising cost of products as well as the rising interest prices on home mortgage as well as vehicle findings- the honest truth that a number of companies, and economic titans at that, are either folding or minimizing workers. You can improve your financial situation greatly by using the right financial resources.

Much uncertainty waits for the air in today’s financial scene triggering the need for useful finance assistance not simply for huge financiers yet right to typical individual trying to endure the day-to-day grind. It would certainly seem like employing an individual economist to help you make likelihoods and ends of your present situation would certainly be pricey as well as can perhaps lower your readily available financial sources likewise even more down.

Financial Resources Suitable for Road to Your Economic Success:

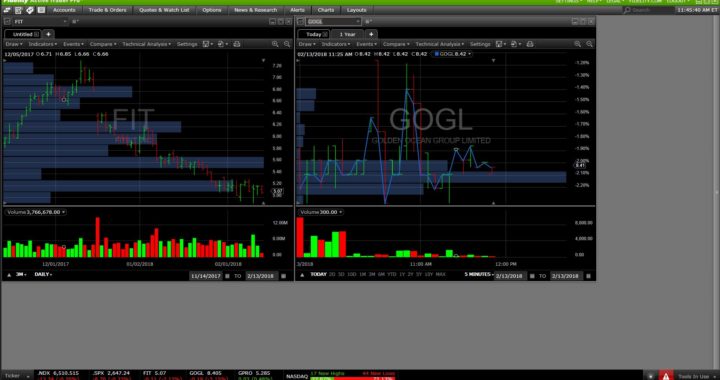

First is investments. There is no warranty that you’ll generate cash from investments you make. Yet if you obtain the basic realities about saving as well as investing and also adhere to using with an intelligent plan, you should certainly manage to obtain economic security as well as safety and security for several years and also indulge in the benefits of handling your money.

No individual is birthed recognizing exactly how you could conserve or to invest. Every effective investor starts with the essentials. A few individuals might stumble into economic protection – a wealthy loved one might die, or a business may eliminate. For great deals of people nonetheless, the only technique to obtain financial protection is to conserve as well as invest over a lengthy amount of time.

Discover if there is any money that could be spent. If so, then consult with financial resources such as an investment broker to check out if precisely what you need to invest is worth the trip. If it is large as well as it is put appropriately, then perhaps there will certainly suffice to use towards your retirement.

When you obtain your entire ducks right, make sure your tax obligation lawyer or accountant realizes your complete monetary development. They can assist you much better plan for the future by recognizing where you go to the present moment. They can additionally supply you some terrific recommendations relating to the very best ways to proceed in your investments.

Time and again, individuals of also moderate means which begin the quest reach financial security and also all that it assures: buying a home, academic chances for their children, as well as a comfy retired life. If they could do it, so might you.

Savings & Budgeting

Second of all is making to get just your basic needs as well as save as much of your incomes as you can. Include your cost savings in your regular monthly budget strategy. It is likewise a good idea to examine your investing methods and also you will be able to check out where you need to make decreasing or you could possibly source for an additional income. If you use bank card, it is very important to manage your investing. They are hassle-free yet at the same time they can land you into a stack of monetary difficulty.

It is vital that you entirely realized just exactly how it works to make sure that you could utilize it appropriately. If you acknowledge that you could not have the discipline as well as you put on not would such as to carry cash around, you can go with a debit card. It functions merely like cash and has a limit relating to simply just how much you can invest.

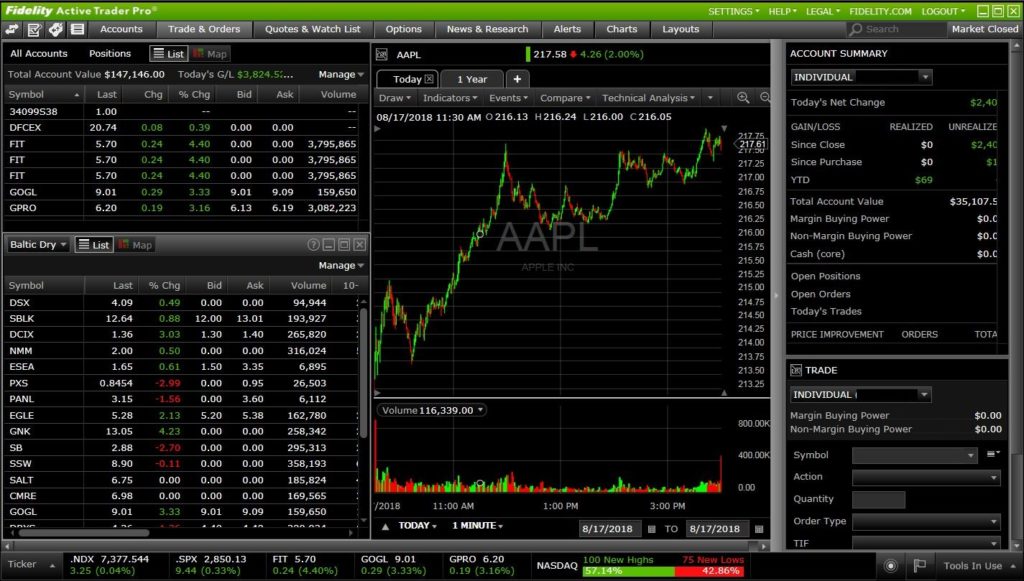

The services of these investment experts can be very advantageous to every investor, either private or institutional. These professionals have in-depth know-how about the asset market, making sure that ROI is maintained by way of making a diversified asset portfolio. Aside from dealing with the funds, investment managers also come up with tailored investment strategic plans in order for the goals of their clients to be realized. However, the investor will be the one who will determine for the style to use. Before the implementation process, the asset management group will talk about things with the investors to finalize everything.

The services of these investment experts can be very advantageous to every investor, either private or institutional. These professionals have in-depth know-how about the asset market, making sure that ROI is maintained by way of making a diversified asset portfolio. Aside from dealing with the funds, investment managers also come up with tailored investment strategic plans in order for the goals of their clients to be realized. However, the investor will be the one who will determine for the style to use. Before the implementation process, the asset management group will talk about things with the investors to finalize everything.