After adding money to your 401k plan over several years, you may have built up a lot of money inside your 401k accounts. These accounts could be a desirable supply of funds for investing in a home. Nevertheless, there tend to be rules as well as restrictions upon withdrawals from the 401k accounts. Fortunately, there may be a way for you to make use of the money within your 401k plan. One great way is using 401k for down payment.

Some 401k programs allow participants to consider a loan from the funds inside the 401k. Usually, the 401k plan will limit the quantity of the loan to some certain percentage from the total balance. This implies that you cannot borrow all the money inside your plan, are just some of it. Nevertheless, this quantity may be significant enough to become useful for the long-term objectives. Check out our 401k calculator to see the impact loans can have on future earnings.

Borrowing From 401k Plan

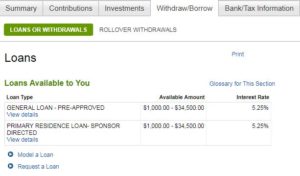

Here’s a screenshot showing what loans you have available through your 401k plan if you’re using Fidelity.

When a person borrow money from the 401k plan, you borrow the cash from yourself. In additional words, the money is withdrawn out of your account as well as distributed for you. That means there isn’t a credit check as well as your credit score doesn’t impact in your loan rate of interest. This is because, there isn’t any risk in order to any lender. You are repaying yourself. Actually, the curiosity you pay about the loan goes straight into your personal 401k accounts. It does not go into any financial institution or loan provider.

Be Aware Of The Rules When Using 401k For Down Payment

However, it doesn’t mean you are able to control how so when you pay back the mortgage. The INTERNAL REVENUE SERVICE has requirements that must definitely be met concerning 401k financial loans. As this kind of, the plan may have a set rate of interest that you need to pay whenever you repay the actual loan. Additionally, you should make well-timed, regular obligations, just like every other loan. Usually, most 401k programs require that you simply make regular monthly obligations to be able to fulfill this particular requirement.

When using 401k for down payment you need to be aware of possible negative situations that may arise. It is necessary that a person make your own 401k program loan obligations. While you will find no lenders involved, and therefore there isn’t any damage for your credit score or credit history, there could be substantial taxes repercussions with regard to failing to settle the mortgage as decided. Any mortgage principal that isn’t repaid is recognized as a distribution through the IRS. Which means that the entire amount associated with any delinquent loan stability is taxable because ordinary earnings. Even worse, if you’re under grow older 59 1/2, then your distribution is going to be considered an earlier distribution and could be susceptible to a 10 % tax fee.

“Using 401k For Down Payment Does Have Its Advantages!”

I would advice against using 401k for down payment, if you already have the cash sitting around. Otherwise, the advantages of using 401k for down payment to purchase a house are extremely advantageous to many people. Nevertheless, it is essential to realize that though it is financing to yourself, it continues to be an actual loan, also it must end up being repaid. If you’re able to do do that, then borrowing using 401k for down payment can be a smart method to finance your house purchase.