“I want to find out who this FICA guy is and how come he’s taking so much of my money.” – Nick Kypreos (former professional hockey player).

Payroll taxes are based on your taxable (rather than gross) wages

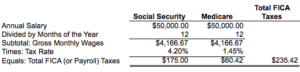

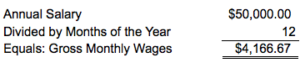

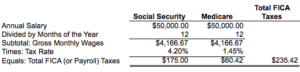

The combined total of your Social Security and Medicare taxes are often referred to as “payroll taxes, ” “FICA,” or “FICA taxes.”[1] The Medicare tax rate on wages is 1.45%. Since 1990 the Social Security portion of FICA has been 6.2% of wages, but for 2011 only the rate was cut to 4.2% as a means to stimulate the economy. Given this is the case, if your salary was $50,000 a year then it would be natural to assume that your monthly Social Security and Medicare taxes would be $235.42, which paystub breakdown is calculated as follows (assuming that the temporary 4.2% Social Security rate applies to this and the other examples that follow).[2]

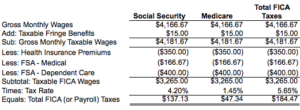

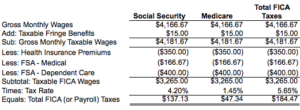

What if I told you instead that your actual payroll taxes were $184.47, or $50.95 less than what you expected ($235.42 less $184.47)? What accounts for the difference? Exactly how is the Social Security and Medicare tax breakdown on your paycheck calculated? To answer that the most important thing you need to understand is that Social Security and Medicare taxes are not driven by gross monthly wages, but by your taxable wages. This is illustrated by the following example, which shows how the $184.47 of payroll taxes referred to above was calculated.[3]

Again, a key thing to take away from this example is that by default your gross wages or salary (the $4,166.67) is the starting point for calculating your payroll taxes, but there certain things which can either increase or decrease your taxable FICA wage base. In the example above you received $15 in non-cash taxable fringe benefits, and that served to increase your FICA taxable base. On the other hand, your health insurance premiums and “FSA” (or “flexible spending account”) contributions served to decrease your FICA taxable base. Thus, after taking into account all of the adjustments shown above, your taxable FICA wage base decreased from $4,166.67 (your gross monthly wages) to $3,265.00.

Why calculate Social Security and Medicare taxes separately?

If you compare the Social Security and Medicare tax calculations above you’ll notice the only difference between the two is that the tax rates are different (4.2% vs. 1.45%). If that’s the case then why calculate the two taxes separately? Why not just take your taxable FICA wages ($3,265.00) and multiply it by 5.65% (4.2% plus 1.45%) to arrive at your total FICA taxes of $184.47 ($137.13 plus $47.34)? There answer is that will actually work for most people. However, there are two reasons you need to be able to calculate your Social Security and Medicare taxes separately.

- The two taxes almost always appear on your paystub as separate figures rather than as one combined FICA tax, so it’s important that you know how to check each of them individually.

- If your taxable wages happen to be in excess of $106,800 (congratulations!) then it throws the math off, because wages in excess of that amount are exempt from Social Security taxes whereas all wages are subject to Medicare taxes.[4]

Verify that your payroll taxes are calculated correctly on your paystub

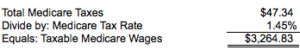

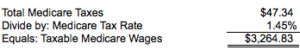

Now that you understand the principles behind calculating Social Security and Medicare taxes, pull out your last paystub and verify that your own FICA taxes are being calculated correctly. If you’re able to successfully do so then feel free to skip to the “Summary” paragraph at the end of this article. If, however, you’re still having trouble verifying that the Social Security and Medicare taxes on your own paystub are being calculated correctly then you first need to determine what your employer is using as your taxable FICA wage base. You do that by dividing the Medicare taxes on your pay stub ($47.34 in our example) by the Medicare tax rate (1.45%), illustrated as follows.[5]

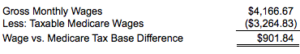

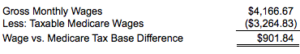

Do you see what you’ve done? Using the formula above you’ve mathematically determined that, according to your company’s payroll department, your taxable Medicare wages are $3,264.83. That’s significant because remember, by default, Medicare taxes are based on your gross wages. Therefore, if your gross wages ($4,166.67) are not equal to your taxable Medicare wages ($3,264.83) then it means they’ve have been adjusted for payroll tax purposes, and the amount of the adjustment can be calculated as follows.

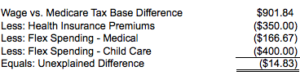

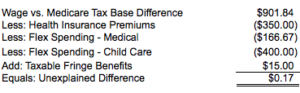

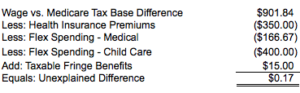

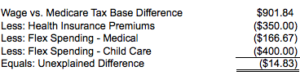

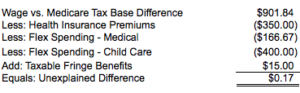

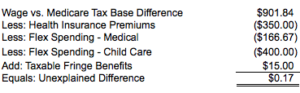

So how do you account for this difference of $901.84 between your gross monthly wages and your taxable Medicare wages? Referring back to earlier illustrations in this article, you will find the following:

What this shows is that after you take into account payroll tax (or FICA) deductions related to your health insurance and flexible spending account contributions, you can fully explain the difference between your gross wages and your taxable Medicare wages except for a fairly small difference of $14.83. Not bad. But wait, if you think about what you read in the previous article about non-cash fringe benefits then does that give you an idea of what the difference could be? It’s very close to the $15 of taxable fringe benefits that you received (see above), and when you add those back then your reconciliation is only off by 17 cents.[6]

In summary, you can verify that your Medicare tax ($47.34) is correct by verifying that your Medicare tax base ($3,265.00) is correct. In addition, once you’ve verified your Medicare tax base, you can use the following method to verify that your Social Security taxes are also being calculated correctly.[7]

Summary

So what’s the point of this whole exercise? After all, isn’t your company’s payroll department supposed to ensure that your Social Security and Medicare taxes are being calculated correctly? Of course they are, but if you’re serious about managing your money then you shouldn’t just blindly fork over $184.47 ($137.13 in Social Security and $47.34 in Medicare taxes) to the government every month unless you know why. No, if you’re serious about managing your money then you’ll make the effort to independently verify that your payroll taxes are being calculated correctly. If you’re unable to do so then contact your employer’s payroll department and have them walk you through how they came up with the numbers on your paystub.

[1] FICA stands for “Federal Income and Contributions Act,” which is where the federal government derives its authority to levy payroll taxes. Source: Internal Revenue Code Section 3101.

[2] For purposes of this example and the ones below it’s assumed you are paid on a monthly basis. However, the same principles apply if you are paid bi-monthly, weekly, etc.

[3] The figures in this example are drawn from my introductory article on how to read checks.

[4] The $106,800 Social Security wage base is accurate for 2017 (it’s adjusted annually for inflation). See https://www.ssa.gov/news/press/factsheets/colafacts2020.pdf. For more information how to handle high wages and other special issues related to Social Security tax calculations click here.

[5] Why is it important to use the Medicare rather than the Social Security tax rate to determine your taxable FICA base? The reason is that Medicare doesn’t have a taxable wage ceiling, so the formula will work every time. On other hand, because the Social Security wage base is capped at $106,800 (2011) then the formula won’t work if your wages happen to be in excess of that amount. If you find this confusing then just remember that it boils down to this: use the Medicare tax rate of 1.45% in the formula!

[6] You don’t need to contact your payroll over an amount as small as 17 cents; it’s just a rounding difference.

[7] Note that if your taxable FICA wages are in excess of $106,800 (based on 2017 figures) then your Social Security taxes for the year should be capped at $4,485.60 ($106,800 times 4.2%).