Understand Pay Stub Meaning & How To Read Checks

Some of your most expensive bills are in your paycheck

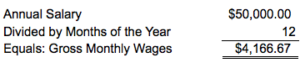

In order to manage your money effectively you need to have a clear understanding of all of your expenses. What many people either forget or don’t realize is that some of their most expensive bills don’t show up in the mail, but in their paycheck! For example, if your salary is $50,000 a year and you’re paid once a month then your gross monthly wages (or salary) would be calculated as follows.[1]

What this means is barring any complicating factors, you should expect to receive exactly $4,166.67 each month. But of course things are not that simple because, as anyone who has ever gotten a paycheck knows, there are complicating factors! As it relates to our example, what if I told you that instead of your take-home pay (meaning the amount of money that actually made it to your bank account) being $4,166.67, it was only $2,482.11? What’s going on here? How can your net pay be $1,684.56 less than what you earned, an amount that’s over 40% of your total paycheck? In short, what financial sharks devoured massive chunks out of your monthly earnings before they ever even got to your bank account?!?

How To Read Checks – Sample Paycheck Breakdown

Based on the figures above, the following breakdown accounts for the $1,684.56 reduction in gross pay of $4,166.67, to arrive at a net paycheck of $2,482.11.

| Gross Wages (or Base Monthly Salary) | $4,166.67 |

| Less: Health Insurance | ($350.00) |

| Less: FSA – Medical | ($166.67) |

| Less: FSA – Dependent Care | ($400.00) |

| Less: Retirement Plan Contribution | ($416.67) |

| Less: Social Security | ($137.13) |

| Less: Medicare | ($47.34) |

| Less: Federal Income Tax | ($65.83) |

| Less: State Income Tax | ($105.92) |

| Less: Disability Insurance | ($30.00) |

| Less: Company Deductions | ($45.00) |

| Add: Reimbursements | $80.00 |

| Equals: Net (or Take-Home) Pay | $2,482.11 |

It’s important to note here that not everything that’s taken out of your paycheck is bad. For example, the $416.67 contribution to your retirement plan will certainly help you in the future, but you also need to take into account that it’s $416.67 less in the current month that you’ll have to pay the bills, cover day-to-day expenses, and do other things you would need or like to.

Know where every penny of your paycheck is going and why

Fully understanding the breakdown of your paycheck is one of the great mysteries of the known universe. To cut through all the complexity, my approach to paycheck analysis boils down to this: if your employer has agreed to pay you $4,166.67 a month then you should expect them to deposit exactly that much each month into your bank account, and if you get any less ($1,684.56 less in our example!) then you should figure out where every penny went and why. The purpose of this article is to give you with a starting point to do just that, by providing you with links to relevant paycheck-related information, examples, and insights (see below).

Related articles and information

To continue this series and read the next article on how to read your paycheck. Also, you can click on any of the links in the sample paycheck breakdown above if you want to go straight to information on a specific area of your paycheck. Finally, you can also refer to other information on taxes.

**********

[1] According to government statistics, the median income of a household in the United States in 2018 was $61,372 (see https://www.census.gov/newsroom/press-releases/2018/income-poverty.html). While that figure is a bit dated, rounding it to $60,000 to make my examples easier to follow.

Pingback: How Social Security Tax & Medicare Tax (or FICA) Work - Debt Free To Early Retirement