An IRA retirement account is one of several critical pieces of planning for retirement. Millions of Americans have an account how they contribute to. If you can be eligible for an account, contributions ought that they are made consistently, each and every year. This stands out as the easiest solution to financially plan on your retirement. To reap the advantages of each using the benefits relating to all the account, you can find some common mistakes that ought to be avoided. The following will discuss 4 within the 9 most frequent retirement mistakes which might be made.

Retirement Mistake #1: Not Naming a Beneficiary

Upon opening an IRA, you aren’t required to name anyone as being a beneficiary for that account. Even though this action seriously isn’t required, it can be strongly suggested. If something happens for you and there isn’t a beneficiary named for the account, it’s going to turn out in probate. This might often be a long, drawn out process which will cost money that didn’t should be spent. The money from the account will likely be disbursed since the remaining life expectancy during the deceased account holder. This is generally a shorter volume of your energy approach expectancy of a beneficiary. In short, which means money will probably be disbursed faster that can place a really heavy tax burden about those who’s receiving the fortune, and that may be determined in probate. Naming a beneficiary once you open the account will eliminate this. You will then be absolutely sure where your remaining account will go after your death. You could also determine how fast the funds is going to be distributed.

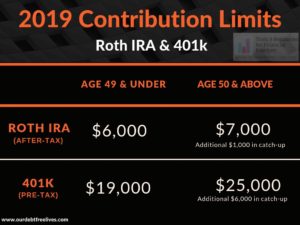

Retirement Mistake #2: Forgetting the Deadline for IRA and Roth IRA Contributions

Don’t forget the core intent behind Roth IRA’s – to fund it just just as much when you possibly can for retirement! Many people believe that one more day they will produce a contribution is on December 31, in one more day within the year. This seriously isn’t true! You may still contribute as much as April 15 of these year. IRA contributions are based for the tax year – not the calendar year, so don’t miss this extra time by assuming the end in the year means the end of contributions. The best way to prevent these common retirement mistakes should be to fund as much as you’ll be competent to early in the year. If you meet the ideal simple contribution limit or Roth IRA contribution limit, you won’t miss out on saving an abundance of funds. The date of April 15 is known for being an extended contribution deadline. These few extra months could create a tremendous difference for some savers as part of your retirement account.

Retirement Mistake #3: Not Knowing Spousal/Non-Spousal Inheritance Rules

There is often a difference in the rules of inheritance that applies to spousal and non-spousal beneficiaries. If you might be a spousal beneficiary, you have two options. You may roll the funds into an account that is already with your name, or else you might change the name on the inherited account. After it truly is complete, the money will be viewed as though it were yours all along. Contribution and withdrawal rules will apply as though it were your own personal account. Non-spousal inheritances work differently. You won’t have the ability to roll the funds over to your individual IRA. You may also be not allowed to generate any contributions for the initial account.

Retirement Mistake #4: Not Contributing Because of Stock Market Volatility

Due towards recent currency markets meltdown, lots of individuals are questioning whether they should continue contributing therefore to their IRAs. The fact is simple. Never stop contributing! Regardless of what are the marketplace is doing at any given time, you ought to take full benefit in the numerous benefits offered by an IRA retirement account. One of those benefits is often a tax break. No matter what are the state from the marketplace is, you will still obtain tax breaks on all money contributed. If you might be lucky enough to figure for the firm that can match your contribution, you will be making much more assets while using the account, along with with the added tax breaks that will of course result in retirement income when it is time for you to spend it.

Related Articles: Traditional IRA vs Roth IRA – Understanding The Difference