When it comes to investing, we want to look for companies that are consistently increasing their earnings per share (EPS). An upward trend in the EPS leads to more consistent results for the shareholders. A down trending EPS or sporadic EPS will usually lead to disappointing results in your investment. When I am looking for solid performing companies that would be good candidates for my dividend growth stock portfolio, one of the first things I always look at is the EPS trend. The next thing you want to determine if the EPS are rising year after year is how the company is achieving these results. When it comes to earnings per share, there are generally only 2 ways that a company can increase them.

Increase Net Income

Companies that are annually increasing their net income are going to be successful. Typically, along with an increased net income will come an increased EPS. The only reason EPS would not increase while net income increases is if the company is diluting the outstanding shares by issuing new shares. As an investor we want to stay away from these situations. We prefer the situations where an increase in net income directly result in an increase in EPS.

Net income is simply Sales or Revenues of a company minus that companies Expenses. The only ways a company can increase their net income is by either increasing sales or by decreasing their expenses. As an investor I like seeing companies who can do both. Keeping expenses within reason means management isn’t wasteful with my capital. Increasing sales means management is doing a good job bringing in revenues to grow the company.

So while both increasing sales and decreasing expenses are a good thing, as an investor I prefer to see the increasing sales. This is because I know customers want whatever it is my company has to offer. The customers are willing to spend their money on the product or services my company offers. Sales increase net income and there is usually no ceiling to how many sales a company can have. If there are customers willing to buy from you, you can make more and more sales. Expenses can be lowered and this will increase our net income. But expenses can only be lowered so much. So while there is a floor to how low a company can make their expenses, there is no ceiling to how high a company’s sales revenue can go. This is why I prefer to see the increasing sales.

When it comes to an increasing EPS trend, I like to see that it is being driven by increasing net income which is also being driven by increasing sales revenues.

Less Shares Outstanding

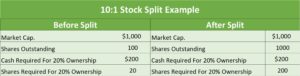

Companies will also see increasing EPS if they are doing share buybacks. Sometimes management will decide to use some of their profits to purchase some of their outstanding shares off the market and retire them. You will notice a downward trend from year to year in the number of outstanding shares. This is a good thing. With fewer shares outstanding, each remaining share is now worth a greater proportion of the company.

If a company is keeping their net income even through the years but decreasing the number of shares outstanding I will still see an increase in my EPS. When I am evaluating companies I like to check the number of shares outstanding to make sure it is either staying flat or decreasing. The last thing I want to see is increasing shares outstanding because I then own a smaller portion of the company.

Conclusion

The bottom line is I like to see increasing EPS. A company can do that by increasing net income, decreasing the shares outstanding or possibly both methods. It is important to analyze the company to determine how they are increasing their EPS. One thing you can be sure of is that if you buy in at the right price and a company is consistently growing their earnings per share, you will most likely enjoy a nice performance from your investment.