5 Steps to Make an Effective Holiday Budget

“Set a gift budget” is often the top suggestion in “smart spending for the holidays”-type articles. I agree that it belongs at the top, but exactly what does setting a budget for the Holidays and/or Christmas mean? Well, it’s far more than a personal pep talk such as, “I’m going to take it easier this year on gifts.” No, setting a budget for Christmas means evaluating your finances and determining exactly how much you can spend and still remain on solid financial footing. And while I believe most people intuitively understand that (whether they choose do it or not), it often doesn’t work. Why? Christmas budgets generally don’t go far enough down into the realities of holiday spending. So if you’ve had trouble with Christmas spending in the past and you’re searching for a better way to keep it under control then I recommend the following holiday budgeting process.

Step #1 – Determine how much you have to spend

As stated above, the first step is to evaluate your finances and determine exactly how much you have to spend for the holidays. Remember to think beyond gifts. For example, depending on your Christmas traditions you might need to take into account getting a Christmas tree, decorations, food for a holiday meal, setting aside money for special donations, etc.

Note that if you’re already disciplined and organized enough to stay within your overall budget then you don’t have to go any further than this step (though I still recommend reading on as you may find these tips helpful). If, however, you believe that you’ll struggle to stay within budget managing a lump sum then follow the additional steps below to bring your holiday spending under control.

Step #2 – Make a list of everyone you would like to get a gift

Let me refine this a little bit: make a list of everyone you would realistically like to get a gift. Of course a list of everyone that you would like to get a gift would be much longer, but unless you’re rolling in money your wallet will never be able to completely afford what you’re heart would like it to. So make out your Christmas list, but don’t go completely overboard.

Step #3 – Determine how much you plan to spend for each person

Estimate by name how much money you think you would have to spend in order to get each person on your list the kind of gift that you would like. Once you’re down then total up the individual amounts.

Step #4 – Rework who you will buy for and how much you will spend until your budget is in balance

Compare the total you came up with in Step #3 to the total amount you have to spend on Christmas gifts that you figured out in Step #1. If you’re at or below budget then you can go ahead and skip to Step #5. If, however, you’re over budget then you have the following 3 options to lower your Christmas spending.

- You can buy fewer gifts for the people on your list (e.g. instead of getting a child 4 gifts you could get them 3).

- You can buy gifts for fewer people, i.e. you can drop some people from your list (some acquaintances, more distant relations, etc.).

- You can spend less money per gift for the people on your list (by thinking ahead, by being creative, or by flat out getting less elaborate gifts).

That’s it – those are the dials you can turn in order to take control of your Christmas spending. So apply the savings methods you wish to employ, add up the new total and once again compare it to the overall amount you have to spend. Repeat the process until your budget is in balance.

Step #5 – Stay disciplined as you shop by sticking to your plan

Once you have done all of the above then comes the most important thing of all: you need to actually stick to your plan when doing your Christmas shopping. That doesn’t mean that you have to be ridiculously rigid and inflexible as you’re buying. For example, if you see the perfect gift for someone and it’s a little over budget then it’s okay to get it and long as you make sure that you pay a little less for someone else’s gift. In short, you don’t have to follow your holiday budget to the letter, but you do need to maintain a sense of discipline in following your plan.

Example – Applying Holiday Budgeting Principles

Here’s an example of how to apply the holiday budgeting principles outlined above.

Step #1 – After evaluating your finances you determine that you have $500 to spend on Christmas gifts.

Step #2 – Here is a list of the people you would like to buy gifts for.

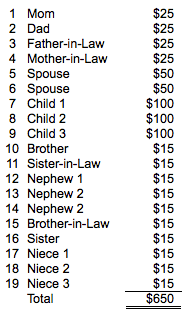

Step #3 – Here is what you feel you would need to spend by person to get each person on your list the kind of Christmas gift that you would like to.

Step #4 – After looking over your Christmas list you determine that the amount you want to spend on gifts ($650 – see Step $3) is $150 less than the amount you have to spend ($500 – see Step #1). So how can you balance your holiday budget? After talking to the families of your brother and sister it turns out that they are having similar struggles. As a result, your families jointly decide on the following:

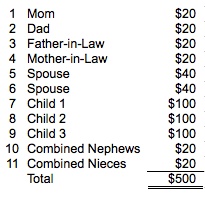

- The adults in your brother and sister’s families agree not to buy for each other.

- You work out a plan to buy group gifts for your nieces and nephews rather than for each individual child.

- You decide to spend a little less on your parents and in-laws.

- Finally, you and your spouse decide to spend a little less than each other.

Now your holiday budget looks like this.

Congratulations, you now have your holiday budget under control! Now all you need to do is limit your gift buying to the people on your list and keep your purchases within the amounts you have set.

Here is more information budgeting.

Pingback: 5 Ways To Save Money On A Tight Budget - Debt Free To Early Retirement