Stock Valuation – The Relationship Between A Company’s Stock Price and Cash

In another article titled Companies To Invest In, I made the point that, at its core, a well-run company is simply a money making machine. That concept – that the value of a company is ultimately tied to cash – is one of the keys to understanding how to value a company and it’s relationship stock price. Stock valuation are great to get quick snapshot of a company’s value. I’ll illustrate this point with a simple example, and then build on it in ensuing articles.

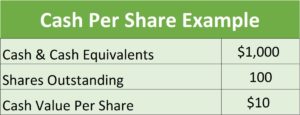

How To Value A Company – Cash Per Share Example 1

If there were a company that had $1,000 in cash with 100 shares of stock outstanding then you could calculate the value of each share of stock as follows.

How To Value A Company – Acquiring 20% Ownership Example 2

If that were the case and you wanted to own 20% of the company then how much stock would you have to buy, and how much would it cost? The answer is that you would have to pay a total of $200 for 20 shares of stock, which can be calculated as follows.

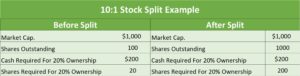

How To Value A Company – 10:1 Stock Split Example 3

What if the company did a 10 for 1 stock split, meaning instead of having 100 shares outstanding, it had 1,000 shares outstanding? Would that change the value of the company? The answer is no. The company’s only asset is $1,000 of cash, and no amount of stock splitting (or combining) can change that. However, by doing a 10 for 1 stock split the value of each individual share is diluted, going from $10 to $1 per share. So in summary, a stock split affects the value of each share of stock, not the value of the company itself, which can be illustrated as follows.

Now, what if our little company went public and was traded on the New York Stock Exchange? Wow, that’s big time! Wouldn’t that would boost its stock price above the $1 it’s now trading at after the stock split? Not at all! The stock could be traded on the moon, and that still wouldn’t alter the fact that the total assets of the company are worth $1,000, making the value of each of those 1,000 shares equal to $1.

How To Value A Company Using The Terminal Valuation Method

But wait, isn’t just focusing on a company’s cash overly simplistic? After all, there’s no company of any size or consequence whose only asset is cash. While that may be true, at the end of the day, determining how to value a company is ultimately measured in money (or cash) – nothing else. This is known as the terminal value of a company.

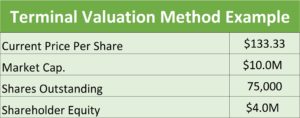

The application of this concept is known as the Terminal Valuation Method. To illustrate how it works, say a company’s stock price is trading at a value that suggests the total worth of the company is $10,000,000.[1] How can you tell if this stock valuation is reasonable? One way to go about it is by to pretending that the company sold everything off: its inventory, furniture and fixtures, real property, and so on, until it converted all of its assets to cash. After going through exercise you estimate that upon liquidating all of its assets and settling all of its outstanding debts (or “liabilities”) that the company would end up with $4,000,000.

“It’s Important To Note Stock Valuation Can Vary Greatly Depending On A Number Of Factors Such As: Industry, Maturity Level of Company, Ect.”

What…$4,000,000? Didn’t we say that the value of the company’s stock suggested that it was worth $10,000,000? Does this mean that the company’s stock price is vastly over inflated relative to its true worth? Perhaps, but not necessarily. For example, aside from tangible assets (assets that you can touch) that could be converted into cash, an established company might have valuable intangible assets that would substantially contribute to its ability to make money: established business relationships, a highly skilled workforce, an efficient supply chain, secret formulas and patents, widely recognized brands and trademarks, etc. In short, there can be a lot more to the value of a company than just its “hard assets” such as cash, inventory, property, etc.

However (and this is a BIG however), if a company is being valued at $10,000,000 and yet it would only be worth $4,000,000 upon liquidation, there still has to be a financial explanation for where that remaining $6,000,000 of value is coming from. In other words, what is it about the company that makes it worth more than sum of its tangible assets? If there is a compelling story there – a story that explains how the company’s business prospects, activities and operations are worth an extra $6,000,000 – then the stock valuation of the company can be justified. If not then the company’s stock price is being pumped up by hype and hot air.

Summary

While it’s true that you cannot you cannot fully measure the value of a company based on its hard assets (cash, inventory, buildings, etc.), it’s also true that a company’s value is ultimately measured in dollars. That means when it comes to a company’s stock valuation, cash is king!

[1] This would be the case if, for example, a company’s stock was trading at $50 a share and there were 200,000 total shares outstanding ($50 x 200,000 shares = $10,000,000).

When considering investing in a company’s stock it’s vitally important to distinguish between evaluating the company vs. considering the

When considering investing in a company’s stock it’s vitally important to distinguish between evaluating the company vs. considering the  be.[1] To illustrate, I was once doing onsite professional work at a company. During one visit I noticed that an employee had a yellow sticky affixed to their computer on which they had written the most popular, trendy dot.com companies of the day – companies whose stock had skyrocketed even though they had no proven profit-making business models. We talked for a minute and I said, “I noticed you’re a big fan of dot.com companies.” The person said yes, and that they were an enthusiastic investor in them, to which I said, “Aren’t you concerned about the high valuations of these companies, even though they’re not making money?” To that the person said, “It’s not about valuation, it’s about revolution.” Upon hearing that my immediate thought was, “SELL! Everybody sell your dot.com stocks now!”

be.[1] To illustrate, I was once doing onsite professional work at a company. During one visit I noticed that an employee had a yellow sticky affixed to their computer on which they had written the most popular, trendy dot.com companies of the day – companies whose stock had skyrocketed even though they had no proven profit-making business models. We talked for a minute and I said, “I noticed you’re a big fan of dot.com companies.” The person said yes, and that they were an enthusiastic investor in them, to which I said, “Aren’t you concerned about the high valuations of these companies, even though they’re not making money?” To that the person said, “It’s not about valuation, it’s about revolution.” Upon hearing that my immediate thought was, “SELL! Everybody sell your dot.com stocks now!” When deciding which companies to invest in you may begin to notice that companies can be hip one day with a high-flying stock price and fall out of favor the next leaving their stock in the tank. Does that make sense? Does the financial outlook of companies really rise and fall so quickly? While it is possible, in the short-term a company’s stock (and the market itself) can frequently be driven by a herd mentality. Warren Buffet has a great quote that summarizes this concept: “In the short run, the market’s a voting machine, and sometimes people vote very non-intelligently. In the long run, it’s a weighing machine, and the weight of business and how it does is what affects values over time.”

When deciding which companies to invest in you may begin to notice that companies can be hip one day with a high-flying stock price and fall out of favor the next leaving their stock in the tank. Does that make sense? Does the financial outlook of companies really rise and fall so quickly? While it is possible, in the short-term a company’s stock (and the market itself) can frequently be driven by a herd mentality. Warren Buffet has a great quote that summarizes this concept: “In the short run, the market’s a voting machine, and sometimes people vote very non-intelligently. In the long run, it’s a weighing machine, and the weight of business and how it does is what affects values over time.”